Exploring The Possibilities: A Guide To Utilizing Your Home For Rental Income

Exploring the Possibilities: A Guide to Utilizing Your Home for Rental Income

Related Articles: Exploring the Possibilities: A Guide to Utilizing Your Home for Rental Income

Introduction

With great pleasure, we will explore the intriguing topic related to Exploring the Possibilities: A Guide to Utilizing Your Home for Rental Income. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Exploring the Possibilities: A Guide to Utilizing Your Home for Rental Income

Owning a house is a significant investment, and many homeowners seek ways to maximize its value and generate income. One avenue for doing so is renting out the property, either in whole or in part. This can be a strategic move, offering financial benefits, tax advantages, and the potential for building a passive income stream. However, determining the most suitable way to rent your house requires careful consideration of several factors.

Understanding the Rental Market:

The first step in deciding how to rent your house is understanding the local real estate market. This involves researching current rental rates for comparable properties in your area, considering factors like:

- Location: Properties in desirable neighborhoods with good schools, amenities, and access to transportation typically command higher rents.

- Property Type: The size, age, condition, and features of the property influence its rental value. A spacious, modern house with updated appliances and a backyard will likely rent for more than a smaller, older property.

- Market Demand: The availability of rental properties and the number of potential tenants in the area impact rental rates. A high demand for rentals in a specific location can drive up prices.

- Seasonal Variations: Rental rates can fluctuate seasonally, with higher demand during peak seasons, such as summer or the school year.

Exploring Rental Options:

Once you understand the local market, you can explore different ways to rent your house:

1. Traditional Rental:

The most common approach is renting the entire house to a single tenant or family. This involves signing a lease agreement outlining the terms of the rental, including rent amount, duration, and responsibilities of both parties.

2. Room Rental:

If you are comfortable sharing your home, you can rent out one or more rooms to tenants. This can be a good option for homeowners seeking supplemental income while maintaining some privacy.

3. Short-Term Rentals:

Platforms like Airbnb and Vrbo allow homeowners to rent out their properties for short durations, typically for vacations or business trips. This can be a lucrative option, especially in popular tourist destinations. However, it requires more flexibility and attention to detail regarding guest management and cleaning.

4. Shared Housing:

This involves renting out individual rooms to multiple tenants who share common areas like the kitchen, living room, and bathroom. This can be an affordable option for renters and a good source of income for homeowners.

5. Student Housing:

If your property is located near a university or college, you can consider renting it to students. This can be a stable and profitable rental market, but it requires understanding the specific needs and preferences of student tenants.

6. Vacation Rental:

Similar to short-term rentals, vacation rentals target tourists and travelers seeking a unique experience. However, vacation rentals often offer amenities and services like kitchens, laundry facilities, and outdoor spaces, catering to longer stays.

Factors to Consider When Choosing a Rental Option:

Selecting the most suitable rental option for your house depends on several factors, including:

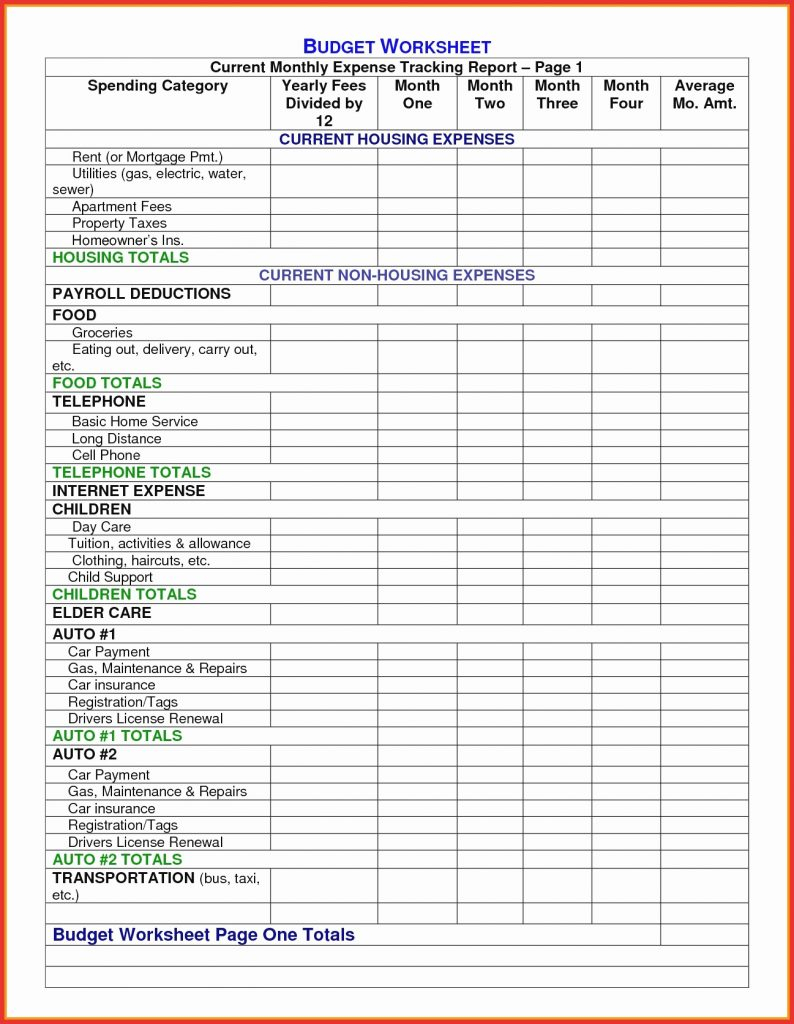

- Your Financial Goals: Determine whether you are seeking supplemental income, a long-term investment, or a full-time rental business.

- Your Personal Preferences: Consider your comfort level with sharing your home, managing tenants, and handling property maintenance.

- Local Regulations: Familiarize yourself with local zoning laws and regulations regarding rental properties.

- Property Condition: Evaluate the condition of your house and whether it requires any renovations or repairs before being rented.

- Insurance Coverage: Ensure you have adequate insurance coverage for rental properties, including liability and property damage.

Legal and Financial Considerations:

Renting your house involves legal and financial obligations. It is essential to:

- Obtain a Rental License: In some areas, you may need a rental license to operate a rental property.

- Screen Tenants: Conduct thorough background checks and credit checks on potential tenants to mitigate risks.

- Prepare a Lease Agreement: A comprehensive lease agreement outlines the terms of the rental, including rent amount, duration, tenant responsibilities, and landlord obligations.

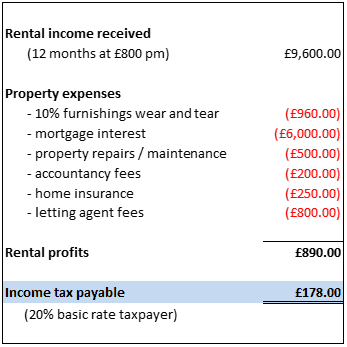

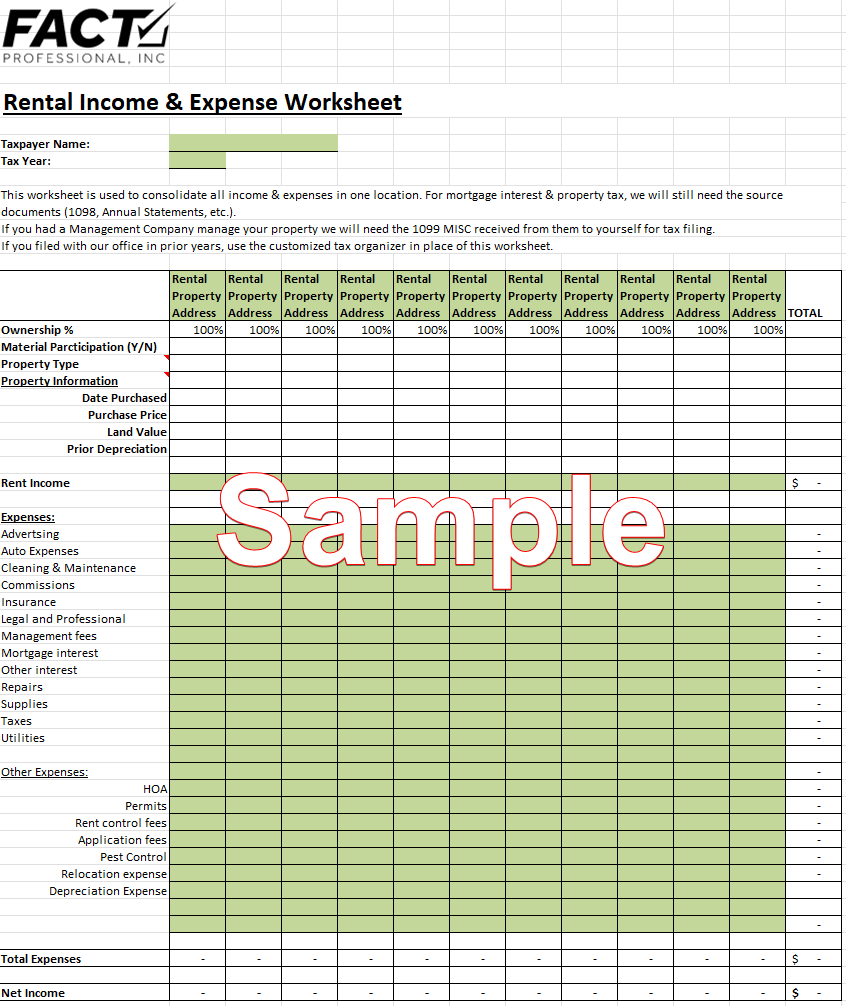

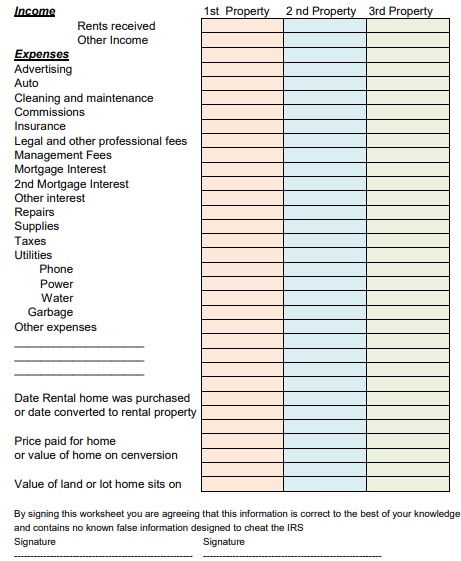

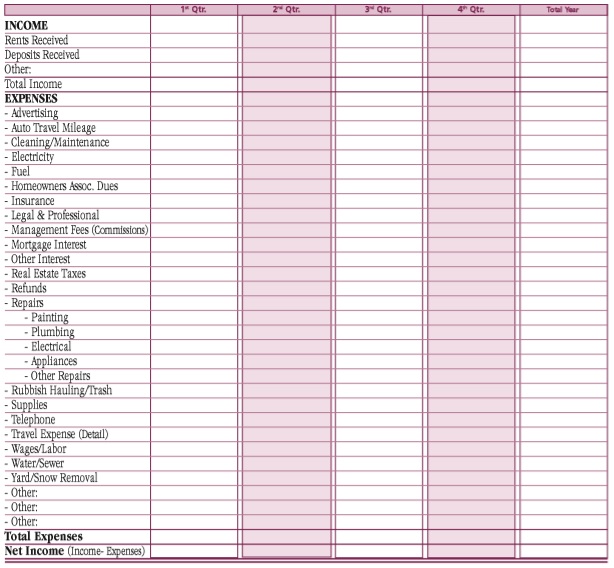

- Understand Tax Implications: Rental income is subject to taxation, and you may be eligible for tax deductions related to property expenses.

- Maintain a Separate Bank Account: Keep rental income and expenses separate from your personal finances for better accounting and tax reporting.

FAQs: Unveiling Common Questions about Renting Your House

1. What are the benefits of renting out my house?

Renting your house can provide financial benefits, including:

- Passive Income: Generate consistent income without actively working.

- Property Value Appreciation: Renting can help maintain and even increase the value of your property.

- Tax Deductions: You may be able to deduct expenses related to your rental property, such as mortgage interest, property taxes, and repairs.

2. What are the potential risks of renting out my house?

Renting out your house involves potential risks, including:

- Tenant Damage: Tenants may cause damage to your property, requiring repairs and expenses.

- Non-Payment of Rent: Tenants may fail to pay rent, creating financial strain.

- Legal Issues: Disputes with tenants can lead to legal complications and expenses.

3. How do I find a reliable tenant?

Thoroughly screening potential tenants is crucial for minimizing risks. Conduct background checks, credit checks, and verify employment and references.

4. What are the legal requirements for renting out my house?

Local regulations and landlord-tenant laws vary by location. Familiarize yourself with these laws to ensure compliance.

5. How much rent should I charge?

Research comparable properties in your area and consider factors like location, size, and amenities to determine a competitive rent amount.

6. What are the tax implications of renting out my house?

Rental income is taxable, but you may be eligible for tax deductions related to property expenses. Consult a tax advisor for specific guidance.

7. What are the insurance requirements for a rental property?

Obtain adequate insurance coverage for your rental property, including liability insurance and property damage insurance.

8. What are my responsibilities as a landlord?

Landlords have legal obligations, such as providing a safe and habitable property, responding to tenant complaints, and adhering to local regulations.

Tips for Maximizing Your Rental Income:

- Maintain Your Property: Regular maintenance and repairs help preserve the value of your property and attract tenants.

- Market Your Property Effectively: Create a compelling listing with high-quality photos and accurate descriptions.

- Screen Tenants Thoroughly: Conduct thorough background checks and credit checks to minimize risks.

- Set Clear Expectations: Communicate rental terms and responsibilities clearly to tenants.

- Respond Promptly to Tenant Requests: Address tenant concerns and requests promptly and professionally.

- Seek Professional Assistance: Consider hiring a property manager to handle day-to-day operations and tenant interactions.

Conclusion: A Path to Profitability and Investment

Renting out your house can be a lucrative way to generate income, build wealth, and maximize your investment. By understanding the rental market, exploring different options, and considering legal and financial implications, you can make informed decisions that align with your financial goals and preferences. Remember, thorough research, careful planning, and responsible property management are crucial for maximizing your rental income and ensuring a positive experience for both you and your tenants.

Closure

Thus, we hope this article has provided valuable insights into Exploring the Possibilities: A Guide to Utilizing Your Home for Rental Income. We hope you find this article informative and beneficial. See you in our next article!