Navigating Probate: Understanding the Process and its Impact on Property

Related Articles: Navigating Probate: Understanding the Process and its Impact on Property

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating Probate: Understanding the Process and its Impact on Property. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating Probate: Understanding the Process and its Impact on Property

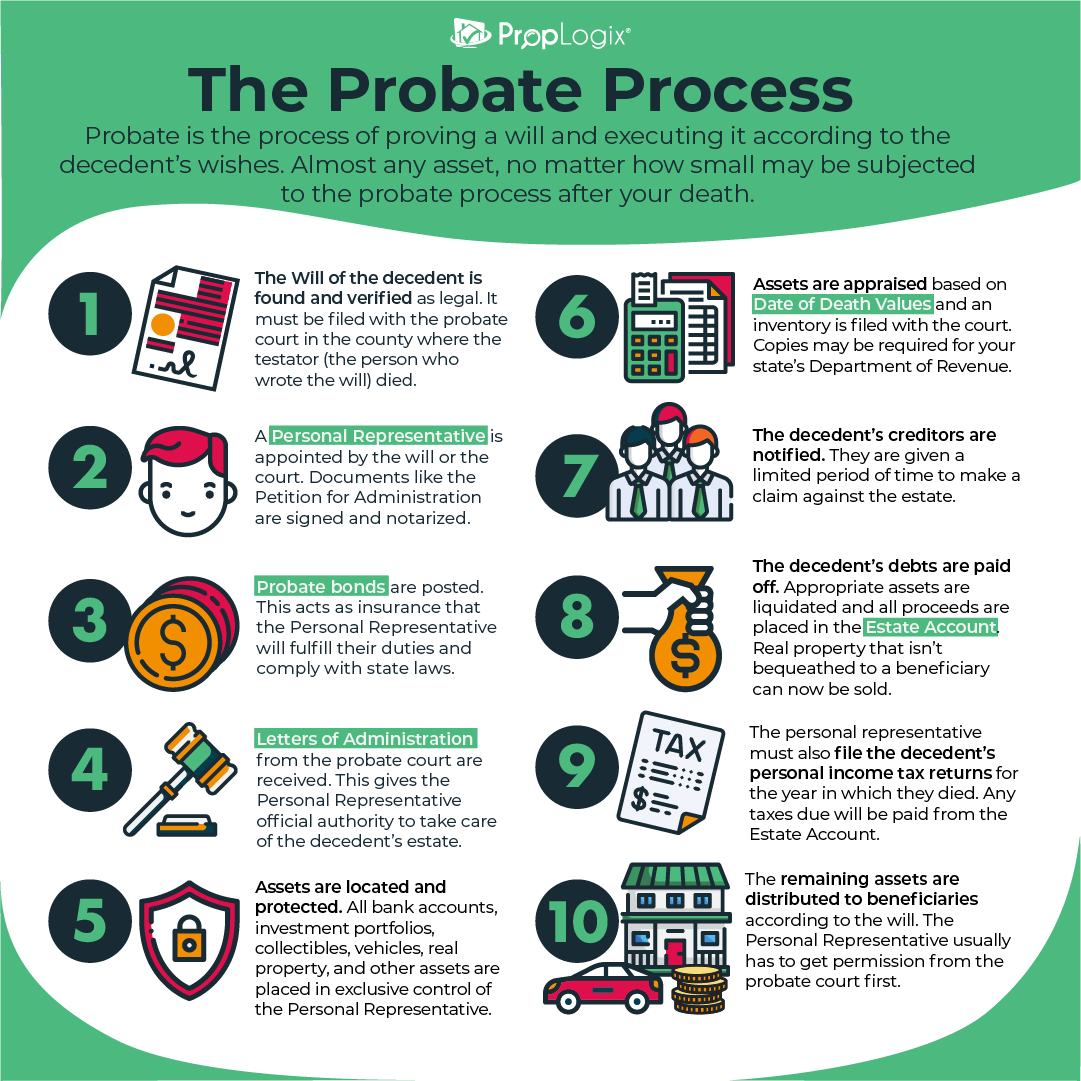

Probate, a legal process involving the administration of a deceased person’s estate, is often a complex and sensitive matter. It involves the identification, valuation, and distribution of assets, ensuring the deceased’s wishes are respected and debts are settled. While the process can seem daunting, understanding its nuances and the types of property subject to probate is crucial for beneficiaries and executors alike.

Property Subject to Probate:

Not all property is subject to probate. The following assets typically fall under the jurisdiction of probate courts:

Real Estate: Land and any structures built upon it, such as houses, apartments, or commercial buildings, are generally subject to probate. This includes properties held in the deceased’s name alone or jointly with another individual.

Personal Property: This encompasses a wide range of assets, including:

- Tangible Assets: Furniture, vehicles, jewelry, artwork, collectibles, and other physical items.

- Intangible Assets: Bank accounts, stocks, bonds, retirement funds, and other financial instruments.

- Intellectual Property: Copyrights, patents, trademarks, and other forms of intellectual property rights.

Exceptions to Probate:

Certain types of property are often exempt from probate, including:

- Joint Tenancy with Right of Survivorship: When property is held in joint tenancy with right of survivorship, ownership automatically transfers to the surviving joint tenant upon the death of the other owner. This eliminates the need for probate.

- Revocable Living Trusts: Assets held in a revocable living trust pass directly to the beneficiaries named in the trust document, bypassing probate.

- Pay-on-Death Accounts: Bank accounts, securities, or other assets designated with a "pay-on-death" beneficiary transfer directly to the named beneficiary upon the account holder’s death, avoiding probate.

The Importance of Probate:

Probate serves several critical functions, ensuring the legal and orderly transfer of assets:

- Validating the Will: Probate verifies the authenticity and validity of the deceased’s will, ensuring it reflects their true wishes.

- Identifying and Valuing Assets: The process involves a comprehensive inventory of the deceased’s assets, including their value, to ensure accurate distribution.

- Paying Debts and Taxes: Probate ensures the deceased’s debts, including taxes, are paid before distributing the remaining assets to beneficiaries.

- Protecting Beneficiaries: Probate safeguards beneficiaries from potential claims by creditors or other interested parties.

- Maintaining Legal Order: Probate provides a legal framework for the orderly transfer of property, ensuring transparency and accountability.

Factors Influencing Probate:

The complexity and duration of probate can vary significantly based on factors such as:

- The Size and Complexity of the Estate: Larger, more complex estates with numerous assets and beneficiaries often require more time and effort.

- The Existence of a Will: The presence of a valid will simplifies the process, while the absence of a will (intestacy) can lead to more complex and potentially lengthy proceedings.

- Contested Wills or Estates: Disputes among beneficiaries or creditors can significantly delay probate.

- State Laws: Each state has its own specific probate laws, which can affect the process and its duration.

Navigating Probate:

Probate can be a challenging process, but understanding the steps involved can help beneficiaries and executors navigate it effectively:

- Gather Necessary Documents: This includes the deceased’s death certificate, will (if applicable), and other relevant documents.

- Appoint an Executor: The executor, named in the will or appointed by the court, manages the probate process.

- Inventory and Value Assets: The executor identifies and values all assets belonging to the deceased.

- Pay Debts and Taxes: The executor settles the deceased’s debts and files tax returns.

- Distribute Assets: The executor distributes the remaining assets to the beneficiaries according to the will or state law.

FAQs on Probate:

Q: What happens if someone dies without a will?

A: If a person dies without a will (intestate), state law dictates how their assets will be distributed. This typically involves a predetermined order of inheritance, often prioritizing close family members.

Q: How long does probate take?

A: Probate can take anywhere from a few months to several years, depending on the factors discussed above.

Q: How much does probate cost?

A: Probate costs vary based on the complexity of the estate, legal fees, and other expenses.

Q: Can I avoid probate entirely?

A: While some assets can avoid probate, it is often advisable to consult with an estate planning attorney to determine the best course of action for specific circumstances.

Tips for Avoiding Probate:

- Create a Will: A well-crafted will ensures your wishes are followed and minimizes potential disputes.

- Establish a Revocable Living Trust: A living trust can help avoid probate for assets held within it.

- Utilize Joint Tenancy with Right of Survivorship: This allows assets to pass directly to the surviving joint tenant.

- Consider Pay-on-Death Accounts: Designate beneficiaries for accounts to ensure direct transfer upon death.

Conclusion:

Probate, while often a necessary process, can be complex and time-consuming. Understanding the nuances of probate, the types of property subject to it, and the various strategies for minimizing its impact is crucial for individuals planning for their own estate or for those navigating the process after a loved one’s passing. Seeking professional legal advice from an estate planning attorney can help ensure a smooth and efficient probate process, protecting the interests of beneficiaries and honoring the deceased’s wishes.

Closure

Thus, we hope this article has provided valuable insights into Navigating Probate: Understanding the Process and its Impact on Property. We appreciate your attention to our article. See you in our next article!