Navigating the Liquidity Landscape: Understanding Assets That Flow

Related Articles: Navigating the Liquidity Landscape: Understanding Assets That Flow

Introduction

With great pleasure, we will explore the intriguing topic related to Navigating the Liquidity Landscape: Understanding Assets That Flow. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Liquidity Landscape: Understanding Assets That Flow

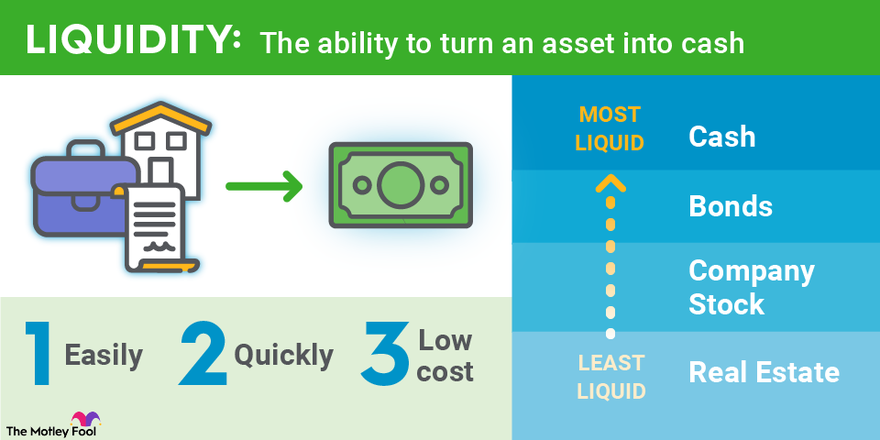

In the financial world, the concept of liquidity plays a crucial role. It essentially refers to the ease with which an asset can be converted into cash without significantly affecting its market value. This ability to access funds quickly is vital for individuals, businesses, and even governments, as it provides a buffer against unexpected expenses, facilitates investment opportunities, and underpins financial stability.

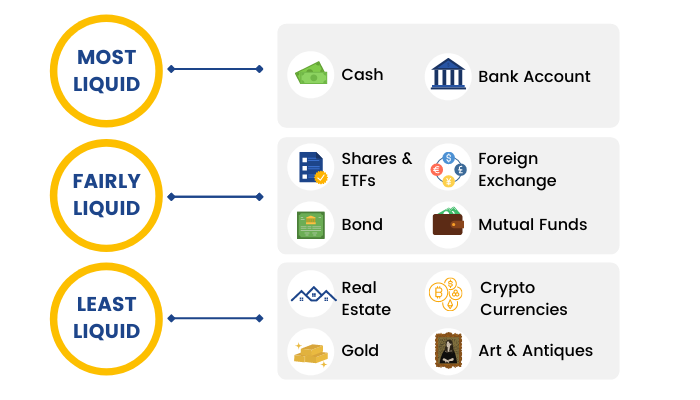

Defining the Liquid Asset Spectrum

The spectrum of liquid assets spans a wide range, with each category possessing varying degrees of liquidity. Generally, assets that can be readily converted into cash without substantial loss in value within a short timeframe are considered highly liquid. Conversely, assets that take longer to sell or involve significant price reductions to find buyers are classified as less liquid.

The Core of Liquidity: Cash and Cash Equivalents

At the pinnacle of liquidity reside cash and cash equivalents. These are the most readily available forms of funds, providing immediate access to purchasing power.

- Cash: This encompasses physical currency (notes and coins) and readily available balances in checking and savings accounts.

-

Cash Equivalents: These are short-term, highly liquid investments that can be easily converted into cash with minimal risk. Examples include:

- Treasury Bills (T-Bills): Short-term debt securities issued by the U.S. government, considered virtually risk-free.

- Money Market Funds: Mutual funds that invest in highly liquid short-term debt instruments, offering a stable return.

- Certificates of Deposit (CDs): Time deposits with fixed interest rates, offering a higher return than savings accounts but with a penalty for early withdrawal.

Beyond Cash: Expanding the Liquid Asset Landscape

While cash and cash equivalents are the most liquid, other assets can also be considered liquid, depending on their specific characteristics:

- Marketable Securities: These are publicly traded securities, such as stocks, bonds, and mutual funds, that can be readily bought and sold on established exchanges. Their liquidity depends on factors like market volatility and the specific security’s trading volume.

- Accounts Receivable: These represent money owed to a business by its customers for goods or services already delivered. Their liquidity depends on the customer’s creditworthiness and the payment terms.

- Inventory: For businesses, inventory can be considered a liquid asset if it can be quickly sold in the market. However, its liquidity can be affected by factors like product obsolescence and market demand.

- Real Estate: While real estate is generally considered a long-term investment, certain types of properties, such as rental properties with high occupancy rates, can be considered more liquid than others.

- Precious Metals: Gold, silver, and platinum are often seen as a safe haven asset, offering some liquidity during economic uncertainty. However, their liquidity can be impacted by market fluctuations and the availability of buyers.

Factors Influencing Liquidity

The liquidity of an asset is not a static concept but is influenced by various factors:

- Market Conditions: In volatile markets, the liquidity of even seemingly liquid assets can be affected.

- Asset Type: As discussed earlier, different asset types have varying levels of liquidity, with cash and cash equivalents being the most liquid.

- Market Demand: The liquidity of an asset is directly linked to its demand. High demand translates to easy conversion into cash.

- Transaction Costs: The costs associated with selling an asset, such as brokerage fees or legal expenses, can affect its perceived liquidity.

The Importance of Liquidity

The benefits of maintaining a healthy level of liquid assets are numerous:

- Financial Flexibility: Liquidity provides the ability to react quickly to unforeseen events, such as medical emergencies, job loss, or business opportunities.

- Risk Management: A sufficient liquidity buffer can act as a cushion against potential losses, reducing the risk of financial distress.

- Investment Opportunities: Liquidity allows individuals and businesses to seize investment opportunities when they arise, maximizing potential returns.

- Business Operations: For businesses, liquidity is essential for maintaining smooth operations, paying suppliers, and meeting payroll obligations.

FAQs

1. What is the difference between liquidity and solvency?

Liquidity refers to the ability to convert assets into cash quickly, while solvency refers to a company’s ability to meet its long-term financial obligations. A company can be liquid but not solvent, meaning it has assets that can be readily converted to cash but may not be enough to cover its long-term debts.

2. How can I improve my personal liquidity?

- Build an emergency fund: Aim to have at least three to six months’ worth of living expenses saved in a liquid account.

- Reduce debt: High debt levels can reduce liquidity by tying up funds in repayments.

- Diversify assets: Having a mix of liquid and illiquid assets can provide flexibility and reduce overall risk.

3. What are some common mistakes people make when managing liquidity?

- Overinvesting in illiquid assets: While long-term investments are important, having too much tied up in illiquid assets can limit your ability to access funds when needed.

- Neglecting an emergency fund: Failing to build and maintain an emergency fund can lead to financial distress in unforeseen situations.

- Not considering transaction costs: Ignoring the costs associated with selling assets can lead to a lower realized return than expected.

Tips for Maintaining Liquidity

- Regularly review your assets: Evaluate the liquidity of your assets and make adjustments as needed to ensure you have sufficient cash flow.

- Develop a budget: A well-structured budget helps you track your income and expenses, allowing you to identify areas where you can save or increase your liquidity.

- Set financial goals: Having clear financial goals, such as retirement planning or buying a home, can help you prioritize saving and investing for future liquidity.

- Seek professional advice: A financial advisor can provide personalized guidance on managing liquidity based on your individual needs and financial situation.

Conclusion

In the dynamic world of finance, understanding the concept of liquidity is crucial. It provides the foundation for financial stability, enabling individuals and businesses to navigate unforeseen events, seize opportunities, and ultimately achieve their financial goals. By understanding the factors that influence liquidity and implementing strategies to maintain a healthy level of liquid assets, you can build a stronger financial foundation and secure your future.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Liquidity Landscape: Understanding Assets That Flow. We hope you find this article informative and beneficial. See you in our next article!