Navigating The Probate Process: A Comprehensive Guide To Estate Administration

Navigating the Probate Process: A Comprehensive Guide to Estate Administration

Related Articles: Navigating the Probate Process: A Comprehensive Guide to Estate Administration

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Probate Process: A Comprehensive Guide to Estate Administration. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Probate Process: A Comprehensive Guide to Estate Administration

Probate is a legal process that occurs after a person dies, involving the administration of their estate and the distribution of their assets according to their will or the laws of intestacy. This process ensures the orderly transfer of property and financial assets to the designated beneficiaries while adhering to legal requirements and protecting the interests of all parties involved. This comprehensive guide delves into the intricacies of probate, outlining the key components, procedures, and considerations involved.

Understanding the Scope of Probate:

Probate encompasses a multifaceted legal framework that governs the handling of a deceased person’s assets, including:

1. Identifying and Verifying the Will:

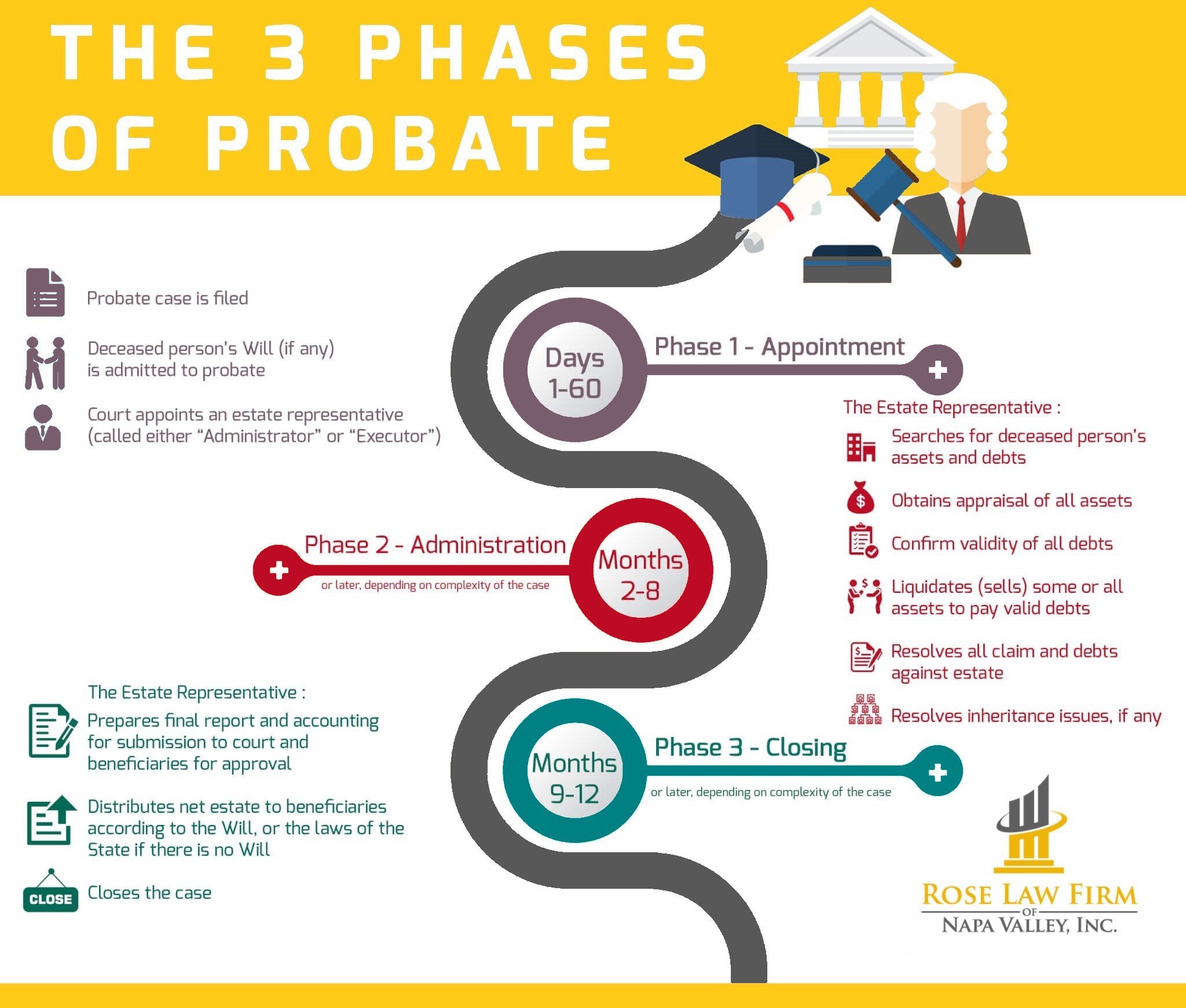

The first step involves locating and authenticating the deceased person’s will, if one exists. This document serves as the primary legal instrument outlining the distribution of assets and the appointment of an executor. If no will is found, the laws of intestacy will determine the distribution of assets.

2. Appointing the Executor:

The will typically designates an executor, who is responsible for managing the estate and carrying out the deceased’s wishes. The executor’s role is crucial in ensuring the smooth and legal transfer of assets to the beneficiaries. If no executor is named, the court will appoint an administrator to oversee the estate.

3. Inventorying and Valuing Assets:

The executor or administrator must meticulously inventory all the deceased’s assets, including real estate, personal property, bank accounts, investments, and other valuables. This inventory includes a detailed description and valuation of each asset, providing a comprehensive picture of the estate’s worth.

4. Paying Debts and Taxes:

The executor or administrator is responsible for paying all outstanding debts and taxes owed by the deceased. This includes funeral expenses, medical bills, credit card debt, and any outstanding taxes. The estate’s assets are used to settle these liabilities before any distribution to beneficiaries.

5. Distributing Assets to Beneficiaries:

Once debts and taxes are paid, the executor or administrator distributes the remaining assets to the beneficiaries according to the will or the laws of intestacy. This process involves transferring ownership of assets, such as real estate, bank accounts, and personal property, to the designated recipients.

6. Finalizing the Estate:

After all assets have been distributed, the executor or administrator files a final accounting with the court, demonstrating the proper handling of the estate and the distribution of assets. This final step formally closes the probate process, ensuring all legal requirements have been met.

Key Considerations in Probate:

1. Legal Representation:

Navigating the intricacies of probate is complex and often requires legal expertise. Hiring an experienced probate attorney can provide invaluable guidance and representation, ensuring all legal requirements are met and protecting the interests of the estate and beneficiaries.

2. Timeframe and Costs:

The duration and cost of probate can vary significantly depending on the size and complexity of the estate, the jurisdiction, and the presence of contested claims. It is essential to understand the potential timeframes and costs involved to plan accordingly.

3. Potential Disputes:

Disputes can arise among beneficiaries or between beneficiaries and the executor or administrator. These disputes often involve disagreements over the will’s validity, the distribution of assets, or the executor’s actions. Mediation or litigation may be necessary to resolve such conflicts.

4. Estate Planning:

Probate can be a lengthy and costly process. Estate planning, including the creation of a will, trust, and other relevant legal documents, can significantly simplify the estate administration process, minimize potential disputes, and ensure the smooth transfer of assets according to the deceased’s wishes.

FAQs on Probate:

1. What is the purpose of probate?

Probate serves to ensure the orderly and legal transfer of a deceased person’s assets to their beneficiaries according to their will or the laws of intestacy. It also protects the interests of creditors and ensures all debts and taxes are paid.

2. Is probate always necessary?

Probate is not always required. If the deceased’s estate is small and consists solely of assets held jointly with another person, probate may not be necessary. However, if the estate includes real estate, significant financial assets, or a complex inheritance structure, probate is usually required.

3. How long does probate take?

The duration of probate varies depending on the complexity of the estate, the jurisdiction, and any potential disputes. In simpler cases, probate may take a few months, while complex cases can take several years.

4. How much does probate cost?

Probate costs can vary widely depending on the size of the estate, the complexity of the process, and the fees charged by legal professionals. It is essential to consult with an attorney to estimate potential costs.

5. Can I avoid probate?

Estate planning strategies, such as creating a trust or holding assets jointly with another person, can help minimize or avoid probate altogether. However, it is crucial to consult with an attorney to determine the most appropriate approach for individual circumstances.

Tips for Managing Probate:

1. Gather Necessary Documents:

Locate and gather all relevant documents, including the deceased’s will, death certificate, birth certificate, marriage certificate, Social Security card, tax returns, and financial statements.

2. Contact an Attorney:

Consult with an experienced probate attorney to understand the process, legal requirements, and potential costs.

3. Inventory and Value Assets:

Create a detailed inventory of all assets, including real estate, personal property, bank accounts, investments, and other valuables.

4. Pay Debts and Taxes:

Settle all outstanding debts and taxes owed by the deceased, including funeral expenses, medical bills, and outstanding taxes.

5. Distribute Assets to Beneficiaries:

Transfer ownership of assets to the designated beneficiaries according to the will or the laws of intestacy.

6. File Final Accounting:

Once all assets have been distributed, file a final accounting with the court, demonstrating the proper handling of the estate and the distribution of assets.

Conclusion:

Probate is an essential legal process that ensures the orderly administration of a deceased person’s estate and the distribution of assets to their beneficiaries. Understanding the intricacies of probate, including the key components, procedures, and potential considerations, is crucial for both executors and beneficiaries. Seeking legal guidance from an experienced probate attorney can provide invaluable support and ensure the smooth and legal transfer of assets according to the deceased’s wishes. By carefully navigating the probate process, individuals can protect the interests of the estate, beneficiaries, and all parties involved.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Probate Process: A Comprehensive Guide to Estate Administration. We hope you find this article informative and beneficial. See you in our next article!