Navigating The Probate Process: Understanding What Assets Require Court Supervision

Navigating the Probate Process: Understanding What Assets Require Court Supervision

Related Articles: Navigating the Probate Process: Understanding What Assets Require Court Supervision

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Navigating the Probate Process: Understanding What Assets Require Court Supervision. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Navigating the Probate Process: Understanding What Assets Require Court Supervision

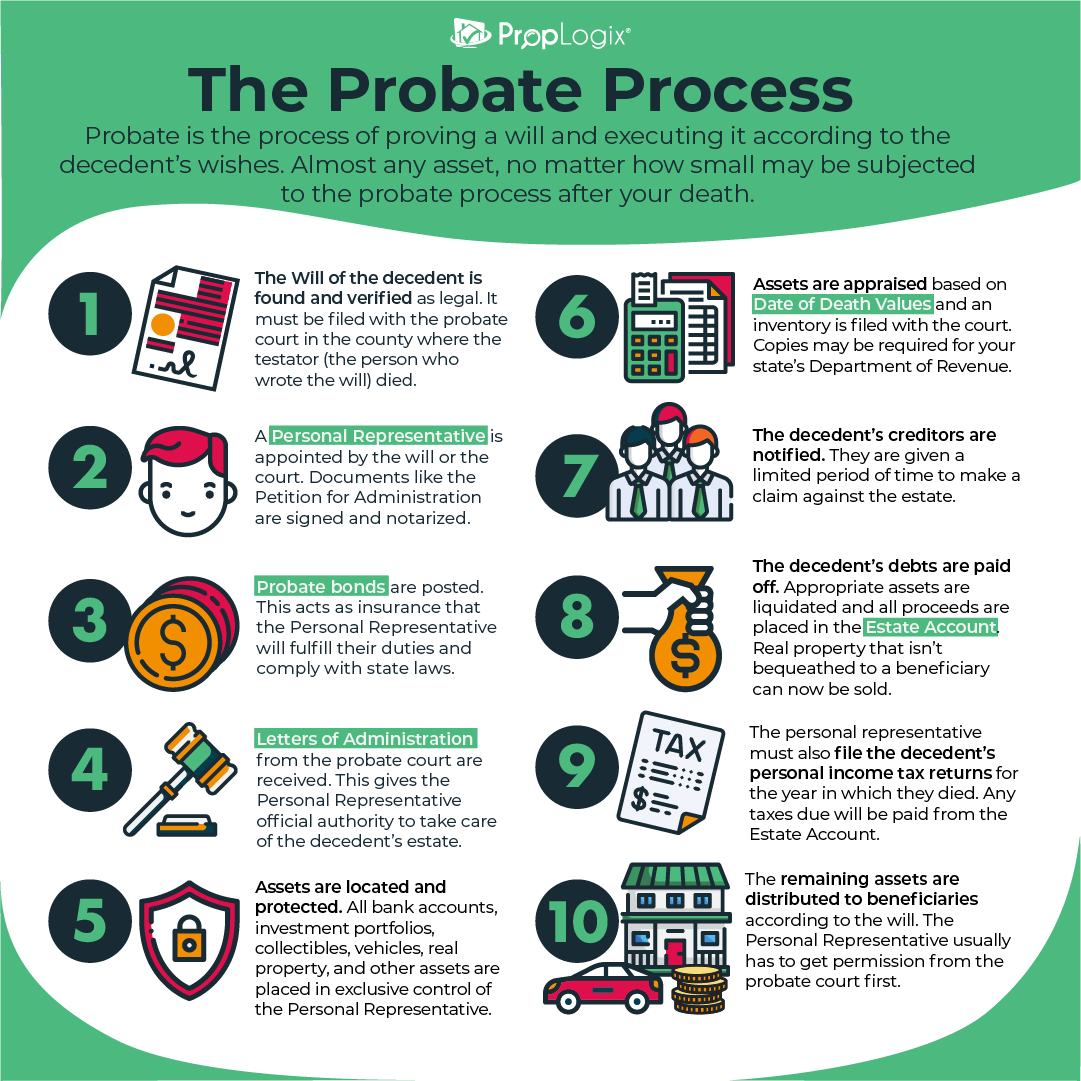

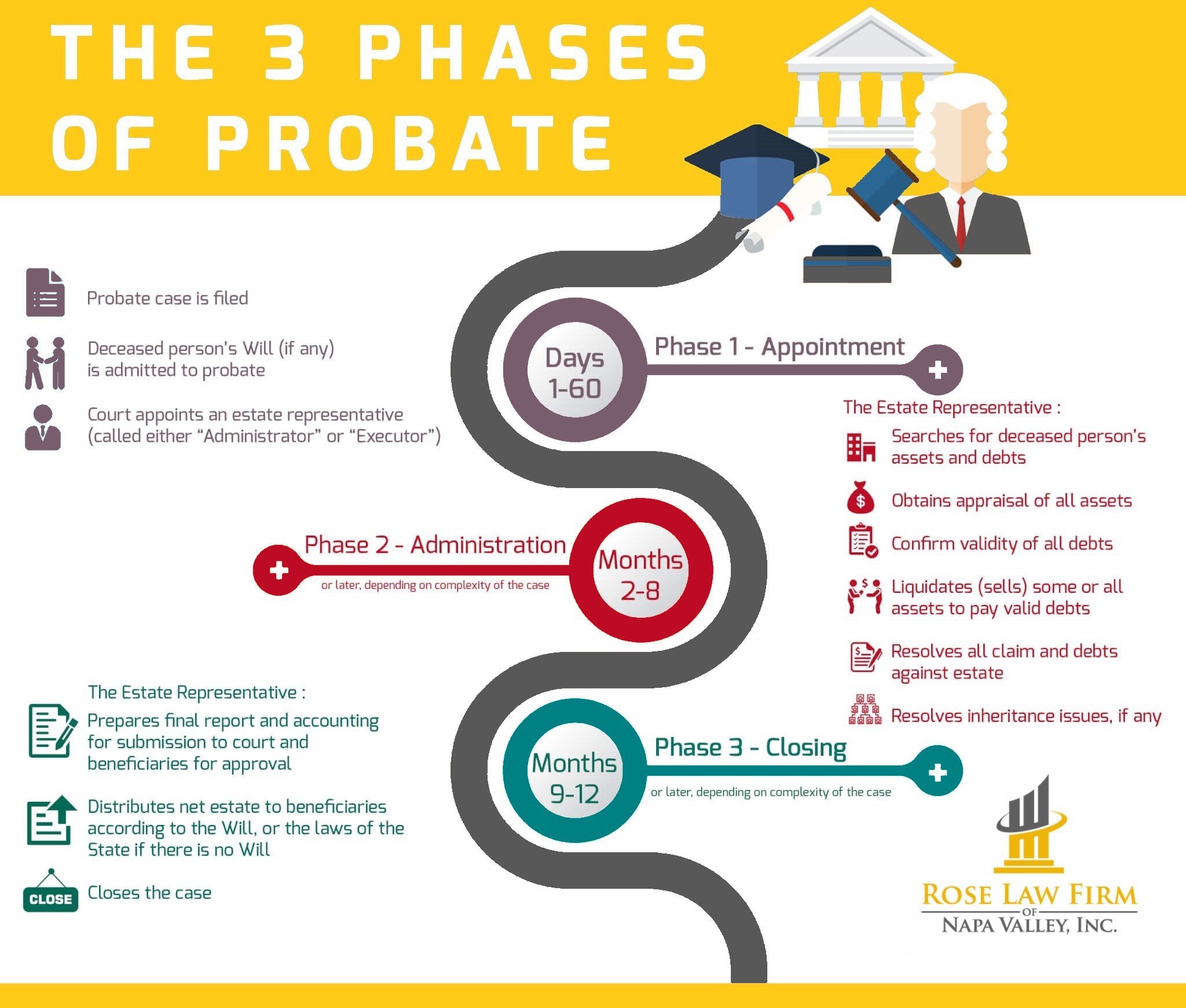

Probate, a legal process that involves the administration of a deceased person’s estate, often evokes a sense of complexity and uncertainty. This process, overseen by a court, aims to ensure the orderly distribution of assets, payment of debts, and fulfillment of the deceased’s final wishes. While not all assets require probate, understanding what falls under its purview is crucial for executors and beneficiaries alike.

What Assets Typically Require Probate?

The need for probate hinges on the nature of the deceased’s assets and the legal framework in place. Generally, assets that require probate include:

1. Real Estate: Property owned by the deceased, regardless of whether it is a primary residence, vacation home, or commercial property, typically necessitates probate. This is because ownership of real estate is recorded publicly, and transferring ownership legally requires court approval.

2. Bank Accounts and Investment Accounts: While some accounts, like joint accounts with rights of survivorship, automatically pass to the surviving owner, individual accounts in the deceased’s name usually fall under probate. This includes checking and savings accounts, stocks, bonds, and mutual funds.

3. Personal Property: This category encompasses a broad range of items, from furniture and vehicles to jewelry and artwork. Unless the deceased specifically designated beneficiaries for these items, they are subject to probate.

4. Business Interests: Ownership of a business or partnership interests, including shares in a corporation or limited liability company, usually require probate. This ensures proper valuation and distribution of the deceased’s stake in the business.

5. Life Insurance Policies: While life insurance payouts are typically exempt from probate, this only applies if the policy names a specific beneficiary. If the beneficiary is the deceased’s estate, the proceeds will be subject to probate.

6. Trusts: While trusts are designed to avoid probate, they may still require a probate process if they hold assets that are not specifically outlined in the trust document. This can occur when the trust itself is not properly funded or if the trustee fails to follow its provisions.

7. Digital Assets: The growing prevalence of digital assets, including social media accounts, online content, and digital currencies, poses a unique challenge. The legal landscape surrounding digital assets is still evolving, and some jurisdictions may require probate for their transfer.

Factors Influencing the Need for Probate:

Several factors can influence whether probate is necessary. These include:

- The Value of the Estate: Estates with a value exceeding a certain threshold, often determined by state law, typically require probate.

- The Complexity of the Estate: Estates with numerous assets, complex financial holdings, or multiple beneficiaries may necessitate probate to ensure proper administration.

- The Existence of a Will: A valid will simplifies the probate process by outlining the deceased’s wishes regarding asset distribution. However, the absence of a will or a will that fails to address all assets can lead to a more complex probate procedure.

Benefits of Probate:

Despite its complexities, probate offers several benefits:

- Legal Validity: Probate provides a legal framework for transferring assets to beneficiaries, ensuring that the transfer is valid and enforceable.

- Debt Resolution: Probate allows for the payment of the deceased’s outstanding debts, protecting beneficiaries from financial liability.

- Asset Protection: Probate safeguards assets from potential claims by creditors or other parties, ensuring that beneficiaries receive their rightful inheritance.

- Fair Distribution: Probate provides a mechanism for fair and equitable distribution of assets, particularly in situations involving multiple beneficiaries or complex family dynamics.

FAQs Regarding Probate:

Q: Is probate always necessary?

A: Probate is not always required. Assets held in joint ownership with rights of survivorship, life insurance policies with named beneficiaries, and assets held in certain types of trusts may avoid probate.

Q: How long does probate take?

A: The duration of probate can vary significantly depending on the complexity of the estate, the jurisdiction, and the cooperation of involved parties. It can range from a few months to several years.

Q: Who is responsible for handling probate?

A: The executor named in the deceased’s will or, if no will exists, the administrator appointed by the court, is responsible for handling the probate process.

Q: What are the costs associated with probate?

A: Probate costs can include court fees, attorney fees, and executor fees. The specific costs vary depending on the estate’s value and the complexity of the process.

Tips for Minimizing Probate:

- Create a Will: A well-drafted will outlining your wishes for asset distribution can significantly simplify the probate process.

- Establish Joint Ownership: Consider creating joint ownership with rights of survivorship for assets like bank accounts and real estate, allowing the surviving owner to inherit the assets directly.

- Utilize Trusts: Trusts can help avoid probate by holding assets outside the estate.

- Designate Beneficiaries: Designate beneficiaries for life insurance policies, retirement accounts, and other assets to avoid probate.

Conclusion:

Probate, while often perceived as a cumbersome process, plays a vital role in ensuring the orderly transfer of assets, the fulfillment of the deceased’s wishes, and the protection of beneficiaries’ interests. Understanding which assets require probate and the factors influencing its necessity can empower individuals to plan for their estate effectively and ensure a smooth transition for their loved ones. By taking proactive steps like creating a will, establishing joint ownership, and utilizing trusts, individuals can minimize the complexities of probate and ensure their assets are distributed according to their wishes.

Closure

Thus, we hope this article has provided valuable insights into Navigating the Probate Process: Understanding What Assets Require Court Supervision. We appreciate your attention to our article. See you in our next article!