The Building Blocks Of Financial Security: Understanding Household Investable Assets

The Building Blocks of Financial Security: Understanding Household Investable Assets

Related Articles: The Building Blocks of Financial Security: Understanding Household Investable Assets

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Building Blocks of Financial Security: Understanding Household Investable Assets. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Building Blocks of Financial Security: Understanding Household Investable Assets

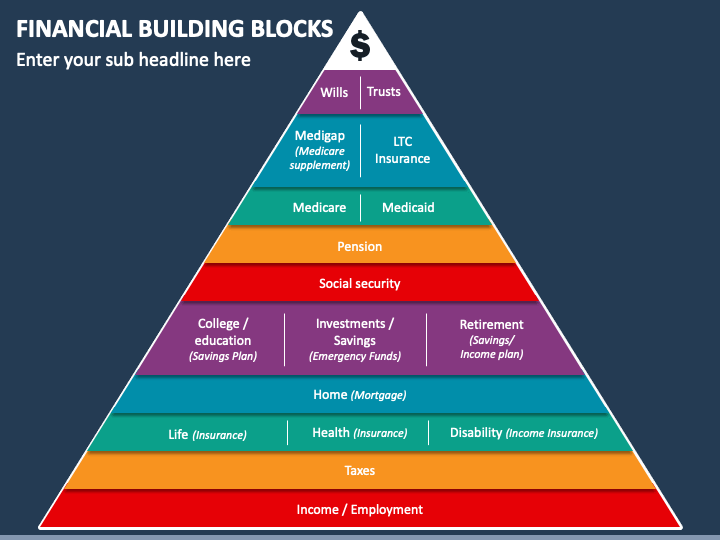

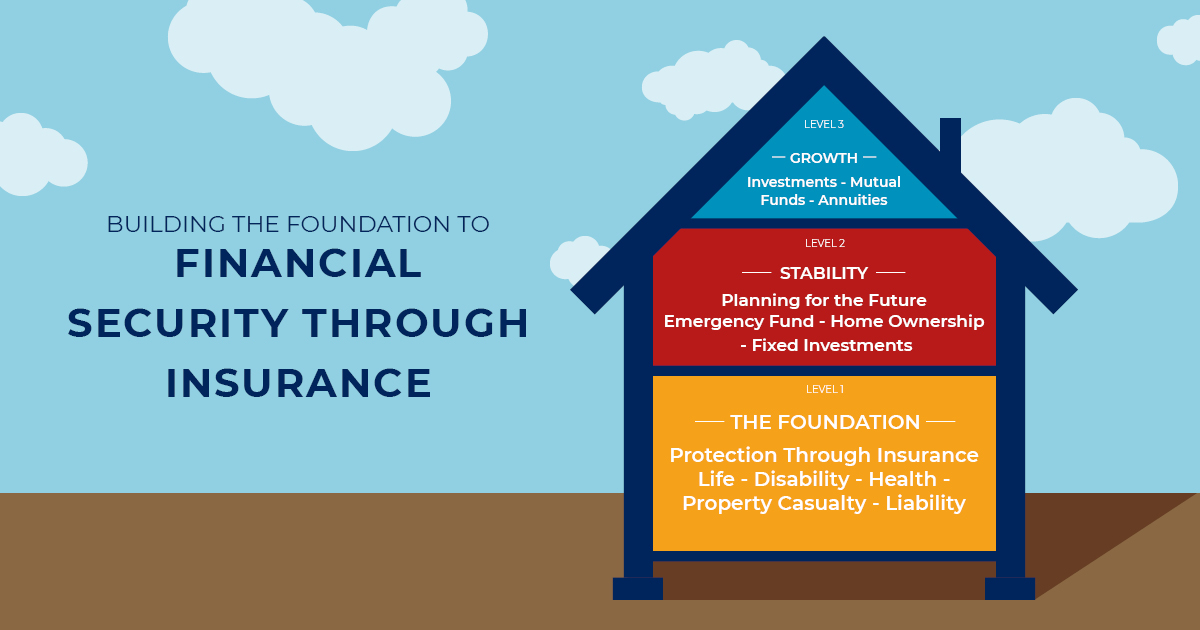

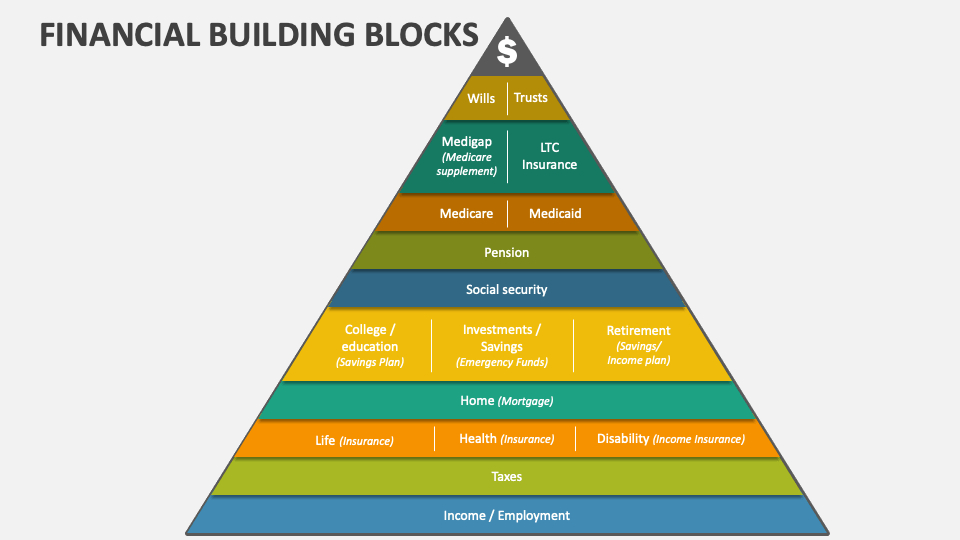

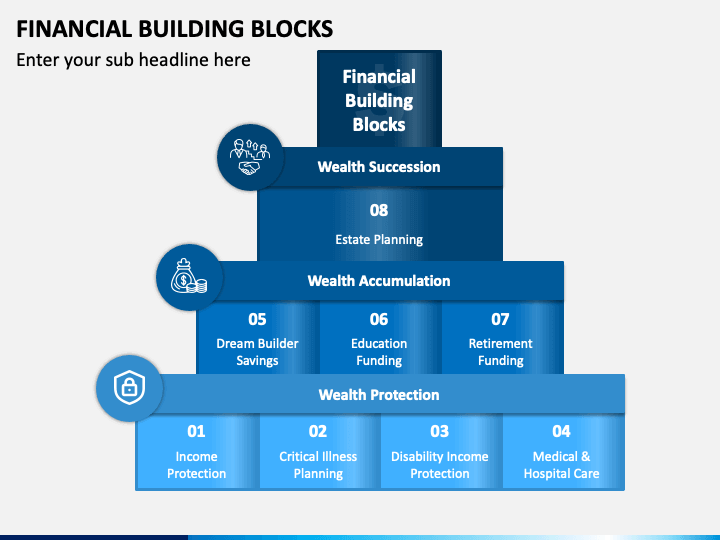

In the realm of personal finance, the term "investable assets" refers to the tangible and intangible possessions that individuals and families hold, which have the potential to generate future financial returns. These assets, when strategically managed, form the foundation of a robust financial portfolio, enabling individuals to achieve their financial goals, secure their future, and build wealth over time.

Defining the Landscape of Household Investable Assets:

The spectrum of household investable assets is diverse, encompassing a wide range of categories, each with its own unique characteristics and risk-return profile. Understanding these categories is crucial for making informed investment decisions and building a well-balanced portfolio.

1. Financial Assets:

- Cash and Equivalents: This category includes readily accessible funds held in checking and savings accounts, money market accounts, and short-term certificates of deposit (CDs). While offering liquidity and safety, they typically generate lower returns compared to other investment options.

- Stocks: Representing ownership in publicly traded companies, stocks offer potential for capital appreciation and dividend income. They are considered a core component of most diversified investment portfolios.

- Bonds: Bonds represent debt securities issued by corporations or governments, promising to pay back the principal amount along with interest payments over a defined period. Bonds offer lower risk compared to stocks but generally provide lower returns.

- Mutual Funds and Exchange-Traded Funds (ETFs): These investment vehicles pool money from multiple investors to purchase a diversified portfolio of stocks, bonds, or other assets. Mutual funds are actively managed, while ETFs are passively managed, tracking a specific index.

- Real Estate Investment Trusts (REITs): REITs are companies that own and operate income-producing real estate properties, such as apartment buildings, shopping malls, or office towers. They provide investors with exposure to the real estate market without the direct ownership of properties.

- Annuities: Annuities are financial contracts that guarantee a stream of income payments for a specified period, typically in retirement. They can provide income security and protection against longevity risk.

2. Real Assets:

- Real Estate: Owning a primary residence or investment properties offers potential for capital appreciation, rental income, and tax benefits. However, real estate investments can be illiquid and require significant capital.

- Precious Metals: Gold, silver, and other precious metals have historically served as a safe haven asset during periods of economic uncertainty. They can provide portfolio diversification but lack consistent growth potential.

- Commodities: Commodities include raw materials like oil, natural gas, and agricultural products. Investing in commodities can provide exposure to inflation-sensitive assets but carries high volatility and requires specialized knowledge.

3. Other Assets:

- Collectibles: Antiques, art, stamps, coins, and other collectibles can appreciate in value over time, but their liquidity and valuation can be challenging.

- Intellectual Property: Patents, trademarks, and copyrights represent intangible assets that can generate income or be licensed to others.

- Human Capital: Individuals’ skills, knowledge, and experience represent a valuable asset that can be enhanced through education and training, leading to higher earning potential.

Importance of Household Investable Assets:

The significance of household investable assets extends beyond mere financial accumulation. They play a pivotal role in:

- Securing Financial Future: By strategically investing and growing their assets, individuals can create a financial safety net, ensuring financial stability during life’s uncertainties, such as retirement, unexpected expenses, or economic downturns.

- Achieving Financial Goals: Investable assets provide the means to realize long-term financial aspirations, whether it’s purchasing a home, funding higher education, or securing a comfortable retirement.

- Generating Income: Investable assets can generate passive income streams, such as dividends from stocks, interest payments from bonds, or rental income from real estate, supplementing earned income and enhancing financial security.

- Building Wealth: Through careful investment and asset management, individuals can grow their wealth over time, achieving financial independence and leaving a legacy for future generations.

- Protecting Against Inflation: Certain investable assets, such as real estate and commodities, can act as a hedge against inflation, preserving purchasing power and mitigating the erosion of savings.

Benefits of Diversification:

Diversifying across different asset classes is crucial for mitigating risk and maximizing returns. By allocating investments across stocks, bonds, real estate, and other asset classes, individuals can reduce the impact of market fluctuations on their overall portfolio. A diversified portfolio helps to:

- Reduce Volatility: By spreading investments across different asset classes, individuals can mitigate the impact of market downturns on their portfolio.

- Enhance Returns: Diversification allows investors to capture potential growth opportunities across various sectors and asset classes, increasing the overall return potential of their portfolio.

- Manage Risk: By diversifying, investors can reduce the concentration of risk in any single asset class, mitigating the potential for significant losses.

FAQs on Household Investable Assets:

1. How do I choose the right investable assets for my portfolio?

The selection of appropriate investable assets depends on several factors, including individual financial goals, risk tolerance, time horizon, and investment knowledge. It is advisable to consult with a qualified financial advisor to develop a personalized investment strategy tailored to individual circumstances.

2. What is the role of risk tolerance in asset allocation?

Risk tolerance refers to an individual’s capacity and willingness to accept potential losses in exchange for higher returns. Investors with a higher risk tolerance may allocate a larger portion of their portfolio to stocks, while those with lower risk tolerance may prefer a greater allocation to bonds or cash equivalents.

3. How can I manage my investable assets effectively?

Effective asset management involves regular monitoring, rebalancing, and adjustments to the investment portfolio based on market conditions, personal goals, and changing circumstances. Seeking professional guidance from a financial advisor can be beneficial for long-term asset management.

4. What are the tax implications of owning different types of investable assets?

Different asset classes have varying tax implications. For instance, capital gains from stocks and bonds are taxed at different rates, while rental income from real estate may be subject to depreciation deductions. Understanding the tax implications of different assets is crucial for maximizing after-tax returns.

5. How can I learn more about investing in household investable assets?

Numerous resources are available to enhance investment knowledge, including online courses, books, articles, and financial institutions’ educational materials. Seeking guidance from a financial advisor can provide personalized insights and support in navigating the complex world of investments.

Tips for Building a Strong Portfolio of Household Investable Assets:

- Start Early: The earlier individuals begin investing, the more time their investments have to grow through compounding returns.

- Set Clear Goals: Defining specific financial goals, such as retirement planning, homeownership, or education savings, helps to guide investment decisions and allocate resources effectively.

- Develop a Budget: Creating a budget allows individuals to track their income and expenses, identify areas for savings, and allocate funds for investments.

- Save Regularly: Consistency in saving and investing is crucial for building wealth over time.

- Diversify Investments: Spreading investments across different asset classes helps to mitigate risk and enhance returns.

- Seek Professional Guidance: Consulting with a qualified financial advisor can provide valuable insights, personalized advice, and support in managing investments.

- Stay Informed: Regularly monitoring market trends, economic indicators, and investment performance is essential for making informed investment decisions and adjusting the portfolio as needed.

Conclusion:

Household investable assets serve as the building blocks of financial security, empowering individuals to achieve their financial goals, secure their future, and build wealth over time. Understanding the diverse categories of investable assets, their risk-return profiles, and the importance of diversification is essential for making informed investment decisions. By strategically managing their investable assets, individuals can create a robust financial portfolio that supports their financial well-being and sets the foundation for a prosperous future.

Closure

Thus, we hope this article has provided valuable insights into The Building Blocks of Financial Security: Understanding Household Investable Assets. We thank you for taking the time to read this article. See you in our next article!