The Essence of Liquidity: Understanding Assets That Flow

Related Articles: The Essence of Liquidity: Understanding Assets That Flow

Introduction

With great pleasure, we will explore the intriguing topic related to The Essence of Liquidity: Understanding Assets That Flow. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essence of Liquidity: Understanding Assets That Flow

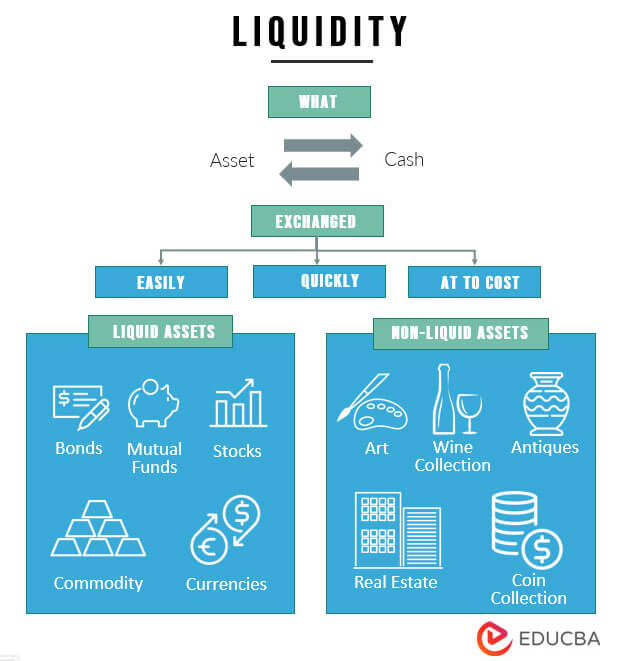

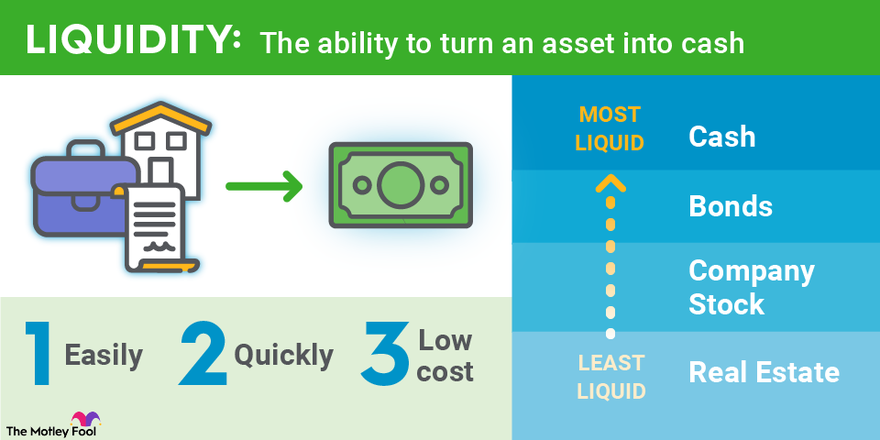

In the realm of finance, the concept of liquidity reigns supreme. It’s the ability to convert an asset into cash quickly and easily, without significant loss of value. This seemingly simple concept underpins a vast array of financial decisions, from personal budgeting to corporate strategy. Understanding which assets possess this crucial characteristic is paramount for navigating the world of investments and financial management.

Defining the Liquid Landscape

The spectrum of assets stretches from highly liquid, like cash, to illiquid, such as real estate. Assets are considered "liquid" based on their inherent convertibility into cash. The key factors determining an asset’s liquidity include:

- Trading Volume: Assets traded frequently in active markets tend to be more liquid. Think of a bustling marketplace where buyers and sellers readily exchange goods – the more transactions, the smoother the flow of value.

- Market Depth: A deep market, characterized by a large number of buyers and sellers, ensures that transactions can occur quickly without significantly impacting the asset’s price. This stability fosters confidence and facilitates liquidity.

- Standardization: Assets with standardized features, such as shares of publicly traded companies, are easier to trade because they are readily understood and comparable. This uniformity simplifies the exchange process and encourages liquidity.

- Transaction Costs: Low transaction costs, such as brokerage fees or taxes, make it more appealing to convert an asset into cash. High transaction costs can act as a deterrent and hinder liquidity.

- Time to Conversion: The time it takes to convert an asset into cash is a crucial indicator of its liquidity. Assets that can be readily converted within a short period, such as stocks or bonds, are considered more liquid than assets that require extended periods for conversion, such as real estate or collectibles.

Navigating the Liquidity Spectrum

With these factors in mind, let’s delve into the diverse world of liquid assets:

1. Cash and Cash Equivalents:

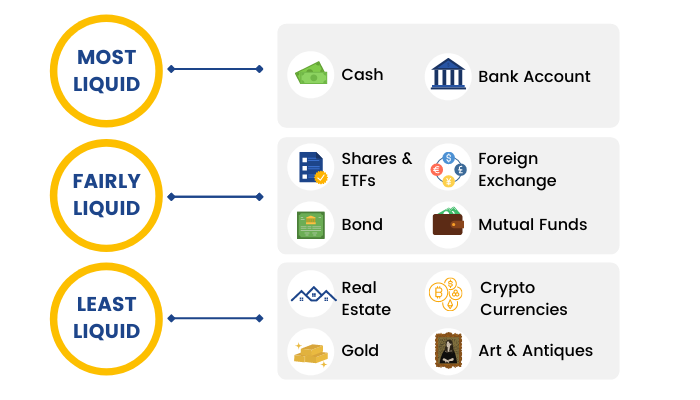

- Cash: The most liquid asset, readily convertible into any other asset.

- Checking and Savings Accounts: These accounts provide immediate access to funds, making them highly liquid.

- Money Market Accounts: These accounts offer slightly higher interest rates than savings accounts while maintaining a high degree of liquidity.

- Treasury Bills (T-Bills): Short-term government debt instruments with maturities of less than a year, considered highly liquid due to their low risk and high demand.

2. Marketable Securities:

- Stocks: Shares of publicly traded companies, representing ownership in the company. Their liquidity depends on factors like market capitalization, trading volume, and company performance.

- Bonds: Debt securities issued by companies or governments, representing a loan to the issuer. Bonds can be traded on exchanges, offering varying degrees of liquidity depending on their maturity, credit rating, and market conditions.

- Mutual Funds: Pools of money invested in a diversified portfolio of securities, offering liquidity through regular trading of their shares.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on exchanges like stocks, offering continuous liquidity.

3. Other Liquid Assets:

- Precious Metals: Gold, silver, and platinum, traditionally considered safe haven assets, can be readily bought and sold in the market, offering a degree of liquidity.

- Commodities: Raw materials like oil, wheat, or copper, traded on exchanges, offer liquidity through futures contracts.

- Short-Term Investments: Assets with short maturities, such as commercial paper or certificates of deposit (CDs), offer higher yields than cash equivalents but may have limited liquidity.

The Importance of Liquidity

The significance of liquidity permeates every facet of financial decision-making:

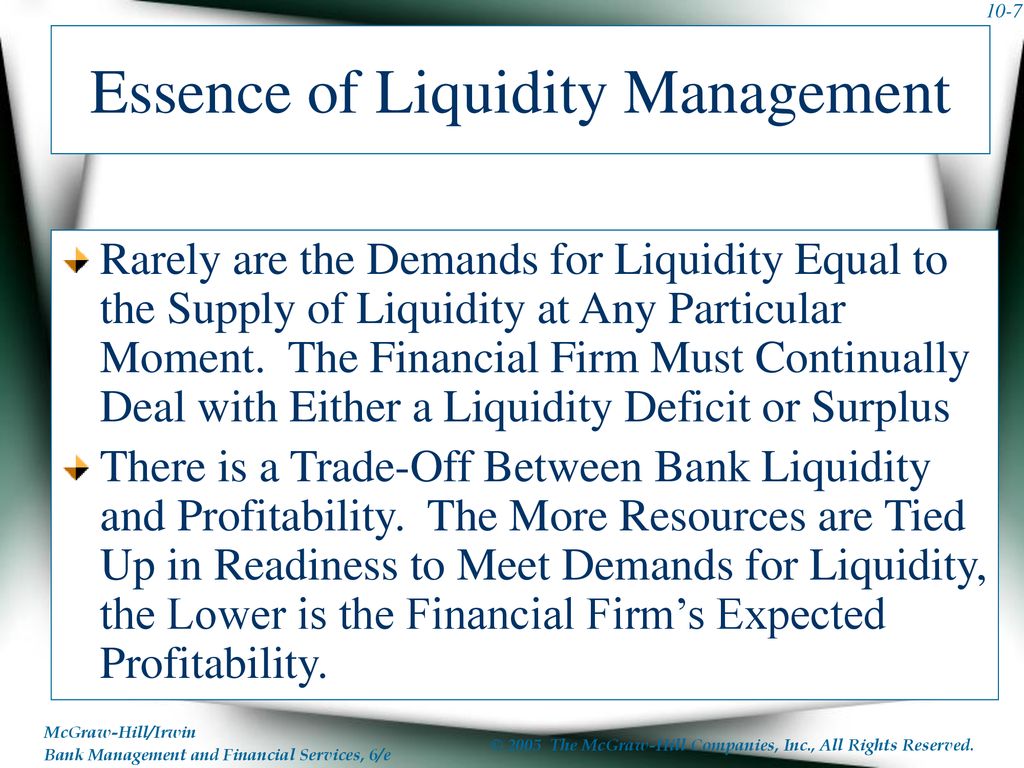

- Meeting Financial Obligations: Liquidity ensures the ability to meet short-term financial obligations, such as paying bills, covering unexpected expenses, or seizing investment opportunities.

- Risk Management: Maintaining a level of liquidity acts as a buffer against unforeseen circumstances, providing a safety net during market downturns or personal emergencies.

- Investment Flexibility: Liquidity empowers investors to adjust their portfolios, capitalize on market opportunities, and manage risk effectively.

- Business Operations: Liquidity is crucial for businesses to meet payroll, pay suppliers, and invest in growth. Adequate liquidity ensures smooth operations and financial stability.

FAQs on Liquid Assets

Q: What is the difference between liquid and illiquid assets?

A: Liquid assets can be readily converted into cash with minimal loss of value, while illiquid assets take longer to sell and may result in significant price depreciation.

Q: Why is liquidity important for individuals?

A: Liquidity provides individuals with the financial flexibility to meet short-term obligations, manage unexpected expenses, and seize investment opportunities.

Q: Why is liquidity important for businesses?

A: Liquidity allows businesses to meet their financial obligations, manage day-to-day operations, and invest in growth opportunities.

Q: What are some examples of illiquid assets?

A: Examples include real estate, collectibles, and private businesses.

Q: How can I improve my liquidity?

A: You can improve your liquidity by increasing your cash reserves, diversifying your investments, and reducing your debt levels.

Tips for Managing Liquidity

- Develop a Budget: Track your income and expenses to understand your cash flow and identify areas for improvement.

- Establish an Emergency Fund: Build a reserve of cash to cover unexpected expenses, minimizing the need to liquidate illiquid assets during emergencies.

- Diversify Investments: Spread your investments across various asset classes, ensuring liquidity through a mix of liquid and illiquid assets.

- Monitor Your Debt: High debt levels can strain liquidity. Prioritize debt reduction to free up cash flow.

- Seek Professional Advice: Consult with a financial advisor to develop a personalized liquidity management strategy tailored to your individual needs.

Conclusion: A Foundation for Financial Security

Understanding liquidity is fundamental to navigating the financial landscape. It empowers individuals and businesses to meet obligations, manage risk, and capitalize on opportunities. By strategically managing liquid assets, individuals and organizations can build a solid financial foundation, fostering stability and resilience in a dynamic world. Remember, liquidity is not merely a financial concept; it’s a vital tool for achieving financial security and pursuing long-term goals.

Closure

Thus, we hope this article has provided valuable insights into The Essence of Liquidity: Understanding Assets That Flow. We thank you for taking the time to read this article. See you in our next article!