The Essence Of Liquidity: Understanding Liquid Assets And Their Significance

The Essence of Liquidity: Understanding Liquid Assets and Their Significance

Related Articles: The Essence of Liquidity: Understanding Liquid Assets and Their Significance

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Essence of Liquidity: Understanding Liquid Assets and Their Significance. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Essence of Liquidity: Understanding Liquid Assets and Their Significance

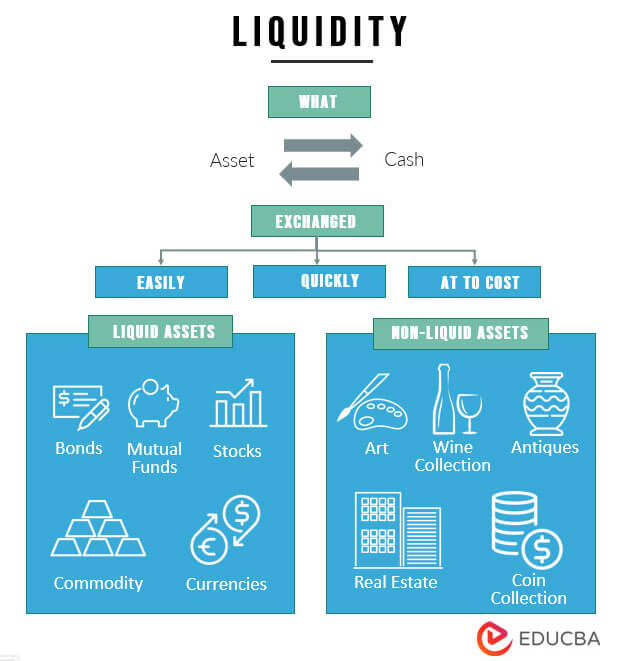

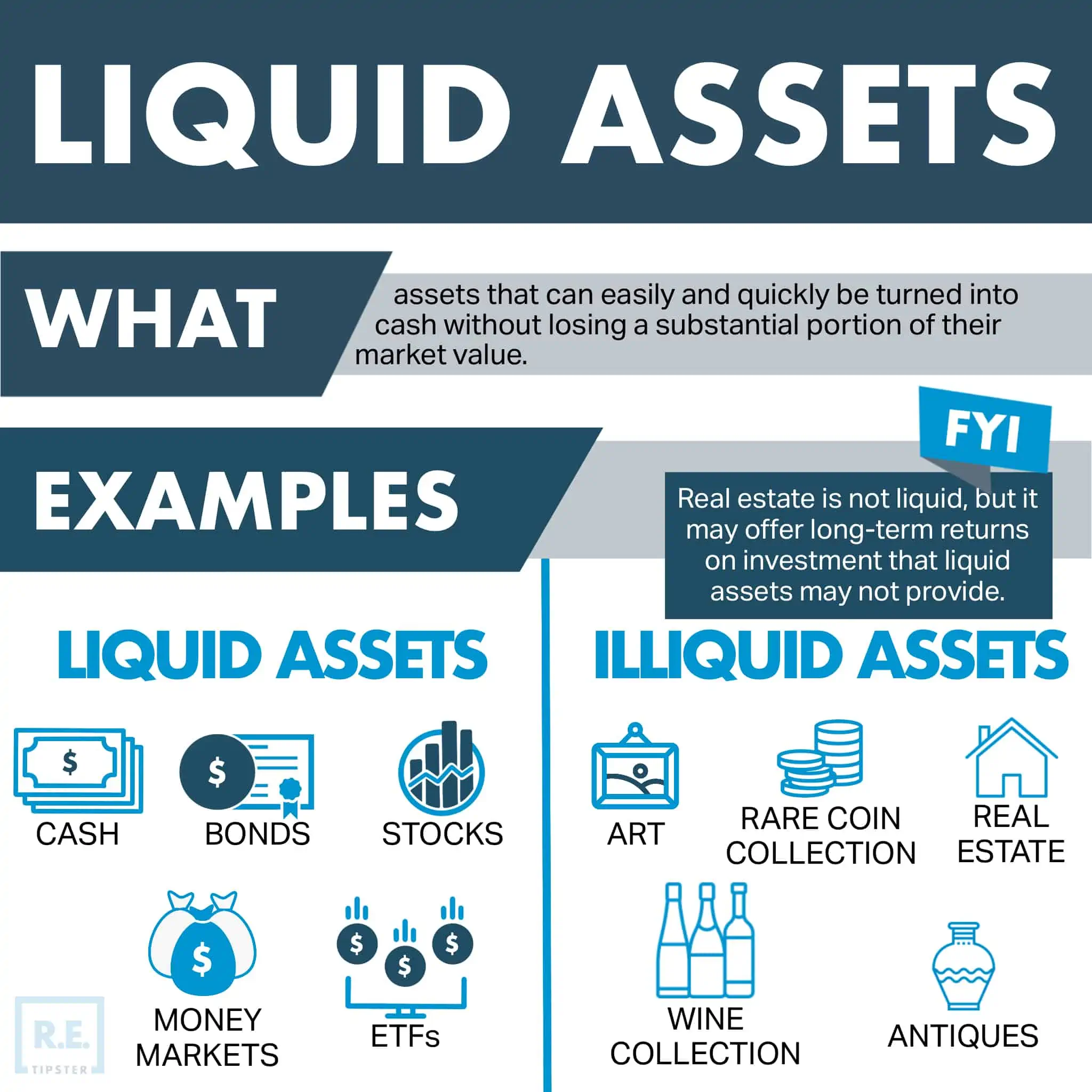

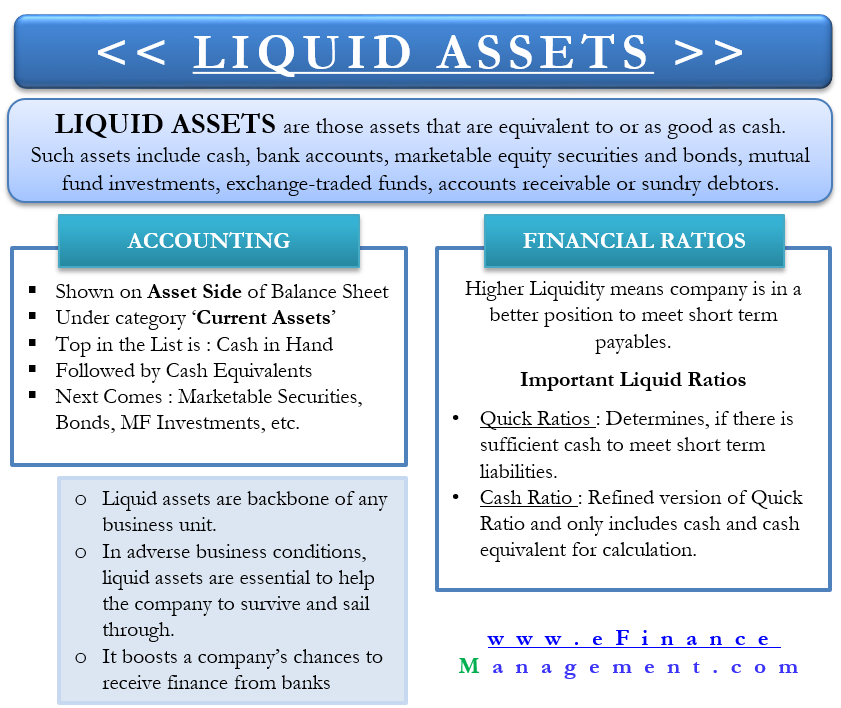

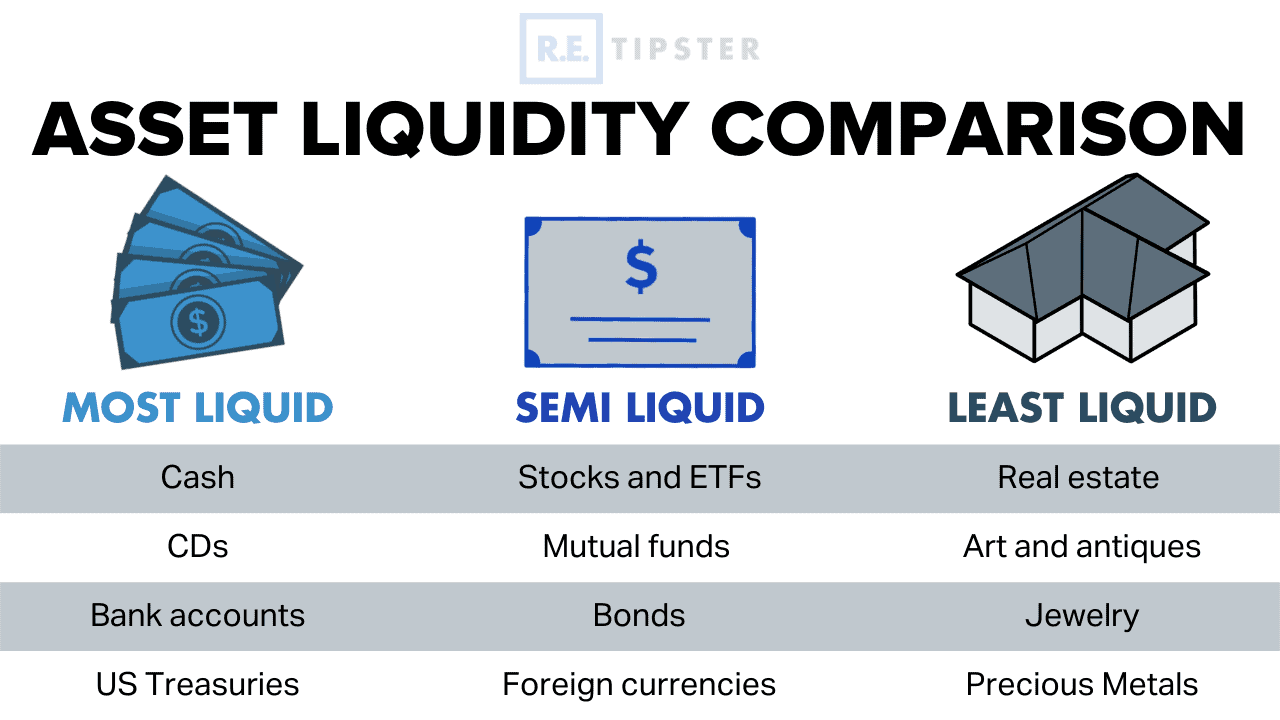

In the realm of finance, liquidity is a cornerstone concept, representing the ease with which an asset can be converted into cash without significant loss of value. Liquid assets, therefore, are those that can be readily transformed into cash within a short timeframe and without a substantial price reduction. Understanding the characteristics and examples of liquid assets is crucial for individuals and businesses alike, as it forms the basis for sound financial planning, investment decisions, and risk management.

Defining the Landscape of Liquid Assets:

Liquid assets are generally categorized as highly marketable and readily available, allowing for quick access to funds when needed. This liquidity is a significant advantage in various financial situations, from meeting unexpected expenses to seizing investment opportunities.

Key Characteristics of Liquid Assets:

- High Marketability: Liquid assets are easily bought and sold in the market, with a large number of willing buyers and sellers. This ensures a rapid conversion to cash without significant price fluctuations.

- Short Conversion Time: The time required to convert the asset into cash should be minimal, typically within a few days or even hours.

- Minimal Price Impact: The conversion process should not result in a significant price discount compared to the asset’s fair market value.

Categories of Liquid Assets:

1. Cash and Cash Equivalents:

- Cash: This includes physical currency, demand deposits in bank accounts, and readily accessible funds in checking accounts. Cash is the most liquid asset, offering instant access to funds.

-

Cash Equivalents: These are short-term, highly liquid investments that can be easily converted into cash. Examples include:

- Treasury Bills (T-Bills): Short-term debt securities issued by the U.S. government with maturities ranging from a few weeks to a year.

- Certificates of Deposit (CDs): Time deposits at a bank with fixed interest rates and maturity dates. While CDs offer higher interest rates, they typically have early withdrawal penalties.

- Money Market Accounts: These accounts offer higher interest rates than traditional checking accounts while maintaining liquidity.

- Commercial Paper: Short-term unsecured debt issued by corporations to finance their operations.

2. Marketable Securities:

These are financial instruments traded on organized exchanges or over-the-counter markets. Examples include:

- Stocks: Represent ownership in publicly traded companies. While stock prices can fluctuate, liquid stocks can be easily bought and sold in the market.

- Bonds: Debt securities issued by corporations or governments, promising to repay the principal amount with interest. While bond prices can fluctuate, highly rated bonds with short maturities are considered liquid.

- Mutual Funds: Investment funds that pool money from multiple investors to invest in a diversified portfolio of securities. Mutual funds can be easily bought and sold, offering liquidity depending on the fund’s underlying investments.

3. Liquid Real Estate:

While real estate is generally considered a less liquid asset, some properties can be considered liquid. These include:

- Rental Properties: Properties leased to tenants, generating consistent rental income. These properties can be easily sold in a market with high demand for rental units.

- Vacant Land: Undeveloped land in areas with high demand for construction or development. These properties can be sold quickly, especially if they are located in prime locations.

Importance of Liquid Assets:

- Financial Security: Liquid assets provide a safety net for unexpected expenses, such as medical emergencies, job loss, or home repairs.

- Investment Opportunities: Liquid assets enable individuals and businesses to seize investment opportunities quickly, such as buying undervalued stocks or investing in promising startups.

- Debt Management: Liquid assets can be used to repay debts, reducing interest payments and improving credit scores.

- Business Operations: For businesses, liquid assets are crucial for meeting short-term obligations, managing cash flow, and funding growth initiatives.

FAQs about Liquid Assets:

Q: What is the difference between liquid assets and illiquid assets?

A: Liquid assets are easily converted into cash with minimal price impact and time delay. Illiquid assets, such as real estate, art, or collectibles, take longer to sell and may experience significant price fluctuations during the sale process.

Q: How can I determine the liquidity of an asset?

A: Consider the asset’s marketability, the time required for conversion, and the potential price impact. Assets with a high volume of trading, short conversion times, and minimal price fluctuations are generally considered more liquid.

Q: What are the risks associated with liquid assets?

A: While liquid assets offer flexibility and security, they may also carry risks:

- Interest Rate Risk: Cash equivalents like CDs and money market accounts may lose value if interest rates rise.

- Market Risk: The value of stocks, bonds, and mutual funds can fluctuate due to market conditions, potentially leading to losses.

- Inflation Risk: The purchasing power of cash can be eroded by inflation, reducing its value over time.

Tips for Managing Liquid Assets:

- Maintain an Emergency Fund: Ensure you have enough liquid assets to cover 3-6 months of living expenses in case of unexpected events.

- Diversify Investments: Allocate your liquid assets across different asset classes, such as stocks, bonds, and cash equivalents, to mitigate risk.

- Regularly Review Your Portfolio: Monitor the liquidity of your assets and adjust your portfolio as needed to meet your changing financial goals.

- Consider Liquidity Needs: When making investment decisions, consider the liquidity requirements of your financial goals.

Conclusion:

Liquid assets are essential components of sound financial planning and management. Understanding their characteristics, categories, and importance is crucial for individuals and businesses alike. By maintaining a healthy level of liquid assets, you can enhance your financial security, seize investment opportunities, and navigate unexpected challenges with greater confidence.

:max_bytes(150000):strip_icc()/Term-Definitions_LiquidAsset-0527b522ceba4808bd4fd02e2b69c64d.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Essence of Liquidity: Understanding Liquid Assets and Their Significance. We hope you find this article informative and beneficial. See you in our next article!