The Evolution Of Household Finances: Exploring The Rise Of Digital Payment Solutions For Family Management

The Evolution of Household Finances: Exploring the Rise of Digital Payment Solutions for Family Management

Related Articles: The Evolution of Household Finances: Exploring the Rise of Digital Payment Solutions for Family Management

Introduction

With great pleasure, we will explore the intriguing topic related to The Evolution of Household Finances: Exploring the Rise of Digital Payment Solutions for Family Management. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Evolution of Household Finances: Exploring the Rise of Digital Payment Solutions for Family Management

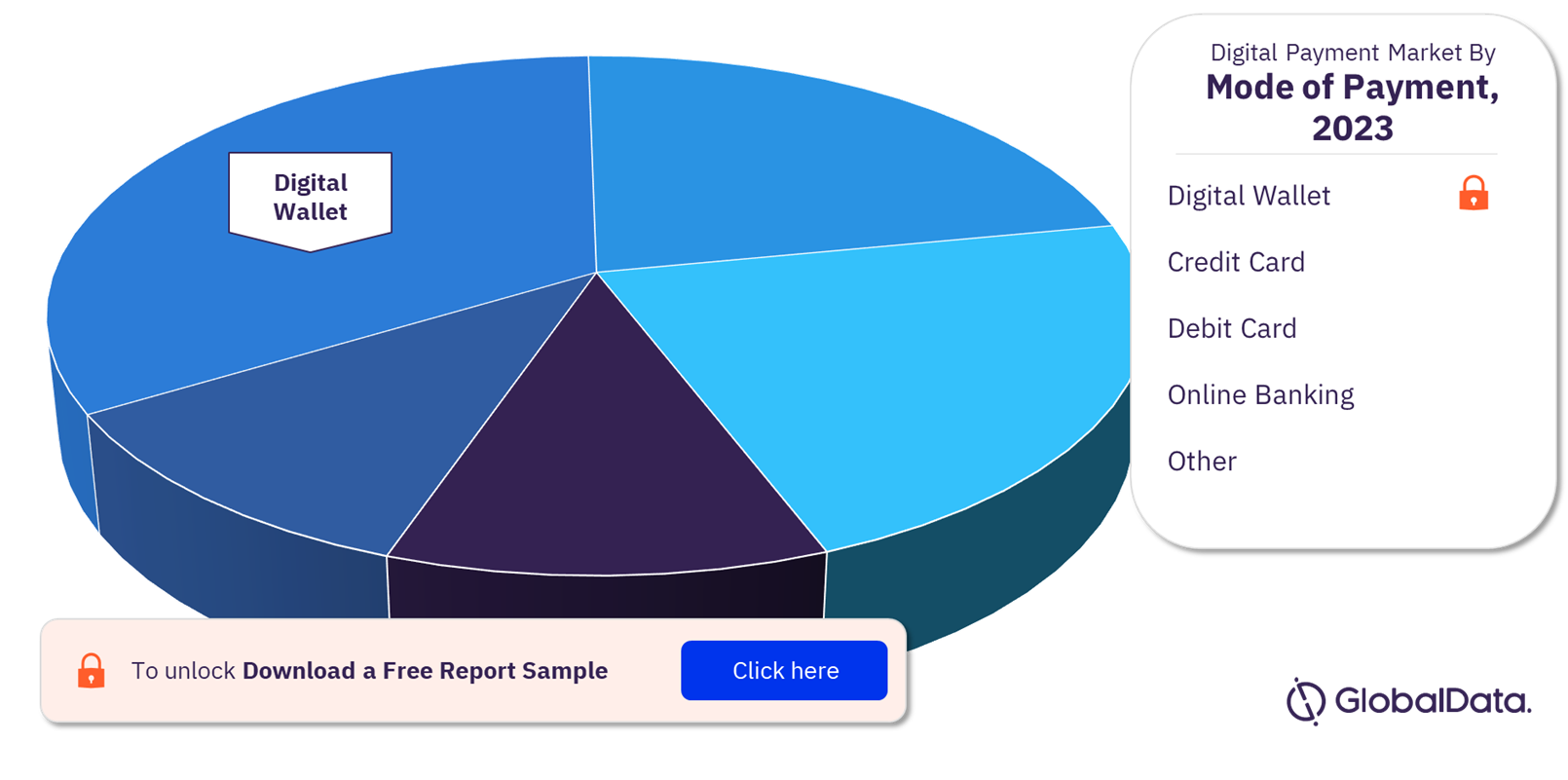

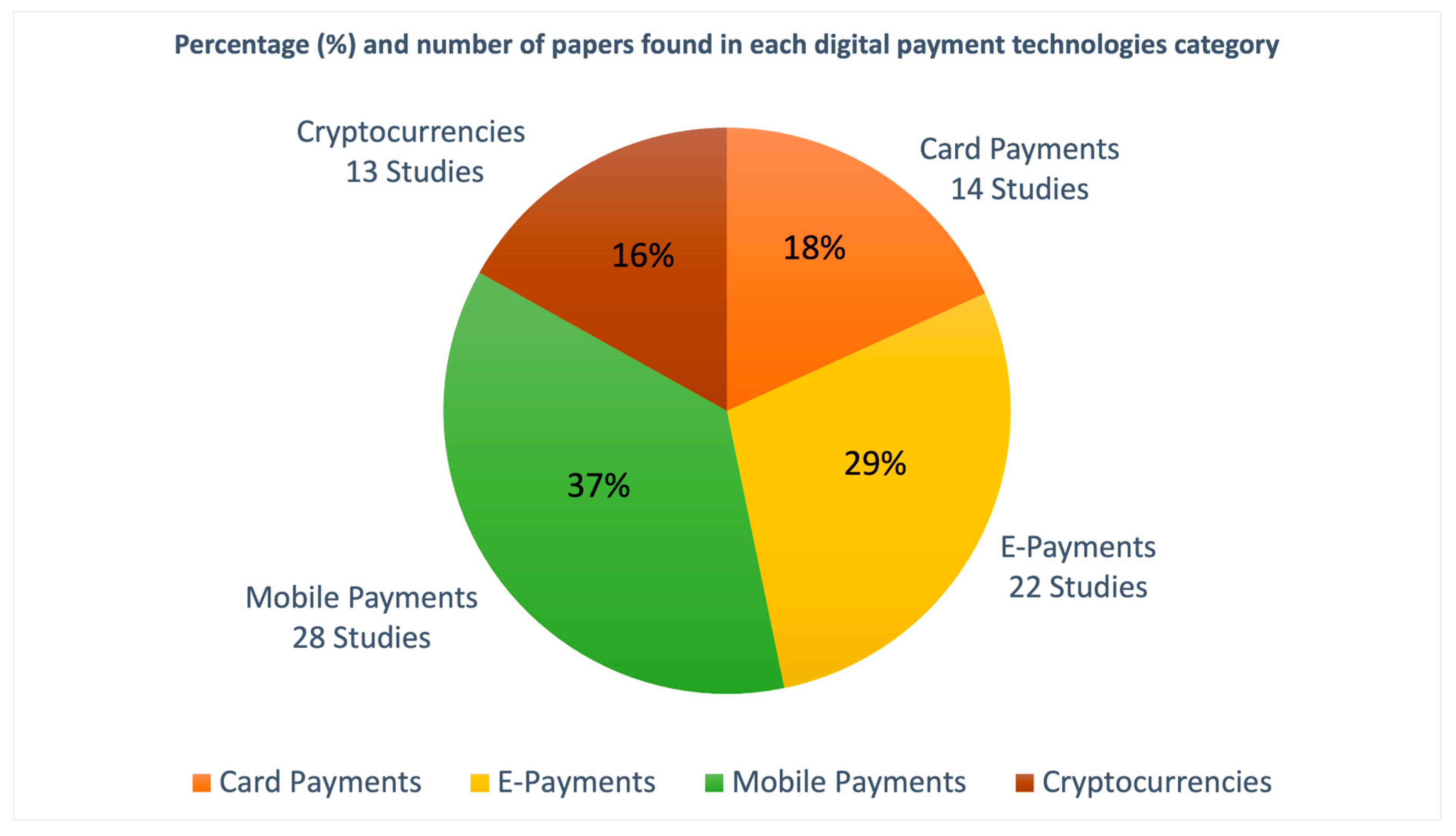

In the digital age, financial transactions have undergone a significant transformation. Traditional methods, such as cash and checks, are increasingly being replaced by convenient and secure digital payment platforms. This shift is particularly evident in the realm of household finances, where families are adopting innovative solutions to manage their everyday expenses. One such solution gaining traction is the use of digital payment platforms for transferring funds between family members, specifically for the purchase of household items.

This article delves into the intricacies of utilizing digital payment platforms, focusing on the implications and benefits of this approach for managing household finances. It aims to provide a comprehensive understanding of the factors driving this trend, highlighting its advantages and potential challenges, while also exploring the future of this evolving landscape.

The Genesis of Digital Payment Platforms in Household Finances

The emergence of digital payment platforms can be traced back to the increasing adoption of smartphones and internet connectivity. These technologies have enabled the development of mobile applications that facilitate secure and convenient money transfers, making it easier for individuals to manage their finances. This evolution has led to the creation of platforms specifically designed for family financial management, allowing for seamless transactions between family members.

WeChat Pay: A Case Study in Digital Payment for Household Items

WeChat Pay, a popular mobile payment platform developed by Tencent, exemplifies the integration of digital payments into household finances. Initially designed for peer-to-peer (P2P) payments within China, WeChat Pay has expanded its functionality to encompass a wide range of services, including online shopping, bill payments, and even charitable donations.

Benefits of Utilizing Digital Payment Platforms for Household Expenses

The use of digital payment platforms for managing household expenses offers several advantages, including:

-

Enhanced Convenience: Digital platforms eliminate the need for physical cash or checks, simplifying the process of transferring funds between family members. This convenience is particularly beneficial for busy families, as it allows them to manage their finances efficiently without having to physically exchange cash.

-

Improved Transparency and Accountability: Digital platforms provide a clear record of all transactions, making it easier for family members to track their spending and ensure accountability. This transparency can foster trust and open communication regarding household finances.

-

Reduced Risk of Loss or Theft: Unlike physical cash, digital funds are protected by robust security measures implemented by the platform provider. This significantly reduces the risk of loss or theft, offering peace of mind for families managing their finances.

-

Streamlined Budgeting and Financial Management: Digital platforms can be integrated with budgeting apps and financial management tools, enabling families to track their spending, set budgets, and monitor their financial progress. This data-driven approach empowers families to make informed financial decisions.

-

Increased Efficiency and Time Savings: By eliminating the need for physical cash transactions, digital platforms streamline the process of purchasing household items, saving time and effort for families. This efficiency allows them to focus on other priorities.

Challenges Associated with Digital Payment Platforms in Household Finances

While digital payment platforms offer numerous benefits, it is important to acknowledge potential challenges:

-

Security Concerns: Despite robust security measures, there is always a risk of data breaches or unauthorized access to accounts. Families must remain vigilant in protecting their personal information and ensuring the security of their digital wallets.

-

Technological Barriers: Not all family members may be comfortable or familiar with using digital platforms. This can create a divide in financial management, potentially leading to exclusion or frustration.

-

Privacy Considerations: The use of digital platforms raises concerns about data privacy, as these platforms collect and store information about users’ financial activities. Families must carefully review the privacy policies of the platforms they choose to use.

-

Potential for Overspending: The ease and convenience of digital payments can make it easier to overspend. Families need to establish clear budgets and spending limits to prevent excessive spending.

Addressing Challenges and Ensuring Responsible Use

To mitigate the challenges associated with digital payment platforms, families can implement strategies for responsible use:

-

Prioritize Security: Choose reputable platforms with robust security measures and enable two-factor authentication for added protection. Regularly monitor account activity for any suspicious transactions.

-

Promote Digital Literacy: Encourage all family members to become familiar with the chosen platform and its functionalities. Provide training and support to those who may require assistance.

-

Establish Clear Communication: Openly discuss privacy concerns and ensure that all family members understand the platform’s data policies. Establish clear guidelines for data sharing and access.

-

Implement Budgeting Strategies: Set clear spending limits and use budgeting tools to track expenses and ensure responsible financial management.

The Future of Digital Payment Platforms in Household Finances

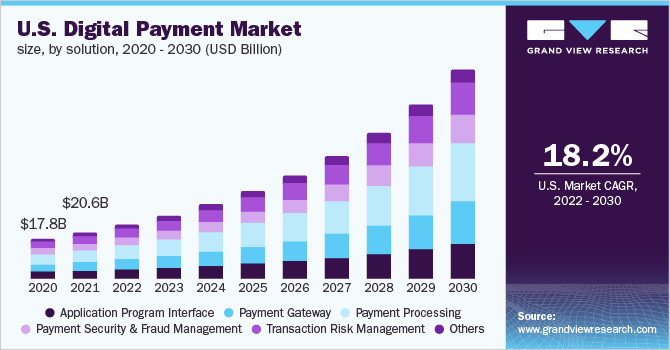

The use of digital payment platforms for managing household expenses is likely to continue growing in the coming years. As technology advances and user adoption increases, we can expect to see further innovation in this space. Future developments may include:

-

Integration with Smart Home Devices: Digital payment platforms could be integrated with smart home devices, enabling seamless payments for household services and utilities.

-

Personalized Financial Management Tools: Platforms may offer personalized financial management tools tailored to individual family needs and preferences.

-

Enhanced Security Features: Advancements in encryption and biometric authentication will further enhance security measures, providing greater peace of mind for users.

-

Increased Accessibility and Inclusion: Platforms will strive to be more inclusive, offering support for various languages and accessibility features to cater to diverse user needs.

Conclusion

The adoption of digital payment platforms for managing household expenses marks a significant shift in the way families handle their finances. These platforms offer numerous benefits, including convenience, transparency, and efficiency, empowering families to make informed financial decisions and manage their budgets effectively. While challenges exist, responsible use and ongoing technological advancements are paving the way for a more secure and convenient future of household financial management.

FAQs

Q: What are the key security considerations when using digital payment platforms for household expenses?

A: When choosing a digital payment platform, prioritize platforms with robust security measures, such as encryption, two-factor authentication, and fraud detection systems. Regularly review account activity and report any suspicious transactions promptly.

Q: How can families ensure that all members are comfortable and familiar with using digital payment platforms?

A: Encourage open communication about digital platforms and their benefits. Provide training and support to those who may require assistance. Consider using platforms with user-friendly interfaces and clear instructions.

Q: What are some tips for budgeting and managing household expenses using digital payment platforms?

A: Set clear spending limits for each category and track expenses regularly. Use budgeting tools to monitor progress and identify areas for improvement. Encourage transparency and communication about spending habits within the family.

Q: What are the potential privacy implications of using digital payment platforms?

A: Carefully review the privacy policies of the platform before using it. Ensure that you understand how your data is collected, used, and shared. Consider platforms that offer strong privacy protections and data encryption.

Q: What are the potential future developments in the use of digital payment platforms for household finances?

A: Future developments may include integration with smart home devices, personalized financial management tools, enhanced security features, and increased accessibility for diverse user needs.

Conclusion

The evolution of household finances is being shaped by the rise of digital payment platforms. These platforms offer a convenient and secure way for families to manage their expenses, fostering transparency and accountability. By understanding the benefits, challenges, and future trends associated with these platforms, families can make informed decisions and leverage these technologies to enhance their financial well-being.

Closure

Thus, we hope this article has provided valuable insights into The Evolution of Household Finances: Exploring the Rise of Digital Payment Solutions for Family Management. We thank you for taking the time to read this article. See you in our next article!