The Fluid Nature Of Wealth: Understanding Liquid Assets In The Modern Financial Landscape

The Fluid Nature of Wealth: Understanding Liquid Assets in the Modern Financial Landscape

Related Articles: The Fluid Nature of Wealth: Understanding Liquid Assets in the Modern Financial Landscape

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to The Fluid Nature of Wealth: Understanding Liquid Assets in the Modern Financial Landscape. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Fluid Nature of Wealth: Understanding Liquid Assets in the Modern Financial Landscape

:max_bytes(150000):strip_icc()/Term-Definitions_LiquidAsset-0527b522ceba4808bd4fd02e2b69c64d.jpg)

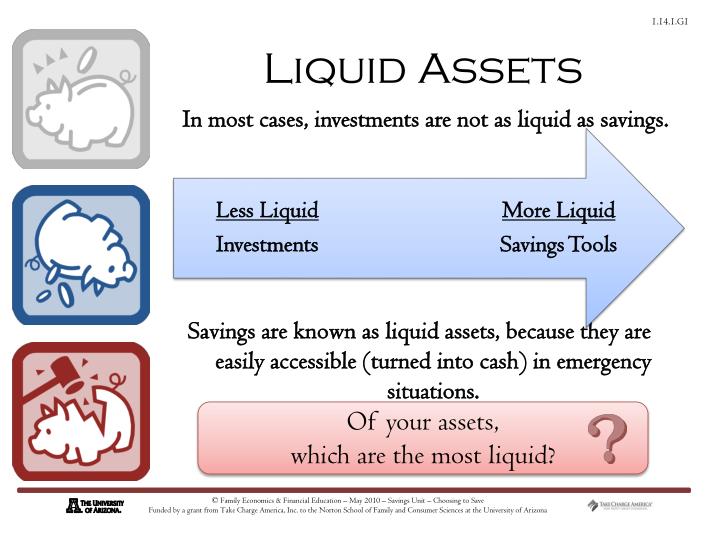

In the realm of finance, the concept of "liquidity" is fundamental. It refers to the ease with which an asset can be converted into cash without significantly affecting its market value. This ability to access cash quickly and readily is crucial for individuals and businesses alike, as it provides flexibility in meeting financial obligations, seizing investment opportunities, and navigating unexpected circumstances.

Defining Liquid Assets: A Spectrum of Accessibility

While the term "liquid" suggests a binary state (either liquid or not), the reality is more nuanced. Assets exist on a spectrum of liquidity, with some being readily convertible to cash while others require more time, effort, or potential price concessions.

Highly Liquid Assets:

- Cash: The epitome of liquidity, cash is readily available for immediate use. This includes physical currency and balances held in checking and savings accounts.

- Money Market Instruments: These short-term debt securities, such as Treasury bills and commercial paper, mature within a year and are easily traded in the market.

- Shares of Publicly Traded Companies: Stocks listed on major exchanges can be bought and sold with relative ease, providing access to funds within a short timeframe.

- Exchange-Traded Funds (ETFs): Similar to stocks, ETFs represent a basket of assets that can be readily traded on exchanges.

- Mutual Funds: While not as liquid as stocks or ETFs, mutual funds can typically be redeemed within a few business days.

Moderately Liquid Assets:

- Real Estate: While houses and commercial properties can be sold, the process can be lengthy and involve significant transaction costs. Market conditions can also influence the sale price.

- Bonds: While bonds are generally considered less liquid than stocks, they can be traded in the market, though the liquidity can vary depending on the type of bond and market conditions.

- Precious Metals: Gold, silver, and platinum are considered relatively liquid assets, but their value can fluctuate significantly, and selling them may require specialized dealers.

Illiquid Assets:

- Private Equity: Investments in privately held companies are generally illiquid, as there is no established market for trading these assets.

- Real Estate Owned (REO): Bank-owned properties, often acquired through foreclosure, can be challenging to sell due to their condition or location.

- Collectibles: Items like art, antiques, or rare stamps can be difficult to sell quickly and at fair market value.

The Importance of Liquidity:

The importance of liquidity stems from its ability to enhance financial flexibility and security.

- Meeting Financial Obligations: Liquid assets provide the necessary funds to pay bills, mortgages, loans, and other financial commitments on time, avoiding late fees and penalties.

- Seizing Investment Opportunities: Having access to cash allows individuals and businesses to capitalize on emerging investment opportunities, such as buying stocks during a market dip or acquiring a promising new venture.

- Navigating Unexpected Circumstances: Unforeseen events like medical emergencies, job loss, or home repairs can necessitate immediate access to funds. Liquid assets provide a financial safety net during such times.

- Managing Risk: Maintaining a certain level of liquidity reduces the risk of having to sell illiquid assets at unfavorable prices to meet urgent financial needs.

Factors Influencing Liquidity:

The liquidity of an asset is not static but can be influenced by various factors:

- Market Conditions: In volatile markets, the value of assets can fluctuate significantly, impacting their ease of sale and potential price realization.

- Market Depth: The number of buyers and sellers in the market for a specific asset influences its liquidity. A deeper market with more participants generally facilitates quicker transactions.

- Transaction Costs: Selling assets often involves transaction fees, such as brokerage commissions, legal fees, and taxes. These costs can impact the net proceeds received and influence the overall liquidity.

- Asset Specificity: Assets with unique characteristics, such as antique furniture or rare collectibles, may be more difficult to sell due to limited demand.

FAQs about Liquid Assets:

Q: Why is liquidity important for businesses?

A: Liquidity is crucial for businesses to manage day-to-day operations, invest in growth opportunities, meet financial obligations, and weather economic downturns. Insufficient liquidity can lead to cash flow problems, difficulty meeting payroll, and even bankruptcy.

Q: How much liquidity should I have?

A: The ideal level of liquidity varies depending on individual circumstances, risk tolerance, and financial goals. A general rule of thumb is to have enough liquid assets to cover three to six months of living expenses.

Q: What are some strategies for increasing liquidity?

A:

- Reduce unnecessary expenses: Identify and eliminate non-essential spending to free up cash.

- Sell illiquid assets: Consider selling assets like collectibles or real estate to generate cash.

- Negotiate payment terms: Extend payment deadlines or request discounts on bills to manage cash flow.

- Diversify investments: Allocate a portion of your portfolio to liquid assets, such as stocks and ETFs.

Tips for Managing Liquidity:

- Regularly review your financial situation: Monitor your cash flow, track expenses, and assess the liquidity of your assets.

- Develop a budget: Create a detailed budget to track income and expenses, helping you identify areas where you can increase liquidity.

- Establish an emergency fund: Allocate a portion of your savings to an easily accessible account to cover unexpected expenses.

- Seek professional advice: Consult with a financial advisor to create a personalized liquidity strategy that aligns with your financial goals and risk tolerance.

Conclusion:

Liquidity is a fundamental concept in finance, shaping financial flexibility and security. Understanding the liquidity spectrum, its importance, and the factors influencing it empowers individuals and businesses to manage their finances effectively, navigate unexpected circumstances, and seize investment opportunities. By maintaining a balance between liquidity and investment growth, individuals and businesses can create a robust financial foundation for achieving their long-term goals.

Closure

Thus, we hope this article has provided valuable insights into The Fluid Nature of Wealth: Understanding Liquid Assets in the Modern Financial Landscape. We hope you find this article informative and beneficial. See you in our next article!