The Foundation of Financial Security: Understanding Household Assets

Related Articles: The Foundation of Financial Security: Understanding Household Assets

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Foundation of Financial Security: Understanding Household Assets. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Foundation of Financial Security: Understanding Household Assets

Household assets represent the tangible and intangible possessions that contribute to a family’s financial well-being. They are the building blocks of wealth, serving as a buffer against financial instability and providing the means to achieve long-term financial goals. Understanding the nature and significance of household assets is crucial for individuals and families seeking to build a secure financial future.

Defining the Landscape of Household Assets

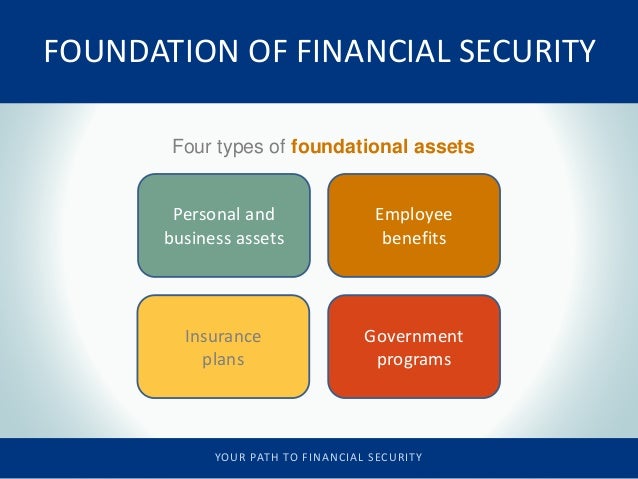

Household assets can be categorized broadly into two distinct types:

1. Tangible Assets: These are physical possessions that have inherent value and can be touched. They can be further subdivided into:

- Real Estate: This category encompasses land, buildings, and other structures owned by the household. Homes, apartments, commercial properties, and vacant land all fall under this umbrella. Real estate often represents the largest portion of a household’s asset base, providing both shelter and potential for appreciation.

- Personal Property: This category encompasses a wide range of items, including vehicles, jewelry, furniture, electronics, and art. While individual items may have varying value, collectively they can represent a significant portion of a household’s wealth.

-

Financial Assets: This category includes tangible assets that are primarily held for their monetary value. It encompasses:

- Cash and Cash Equivalents: This category includes readily available funds such as checking and savings accounts, money market accounts, and short-term investments.

- Investments: This category encompasses a wide range of financial instruments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These investments provide the potential for capital appreciation and income generation.

- Precious Metals: Gold, silver, and platinum are considered tangible assets, often used as a hedge against inflation and economic uncertainty.

2. Intangible Assets: These assets lack physical form but possess inherent value and contribute to a household’s financial well-being. They include:

- Human Capital: This refers to the skills, knowledge, and experience possessed by household members. It is a valuable asset, contributing to earning potential and career advancement.

- Intellectual Property: This category encompasses patents, copyrights, trademarks, and other forms of intellectual creations. It represents valuable assets that can generate income and provide a competitive advantage.

- Social Capital: This refers to the networks of relationships and connections that individuals and families cultivate. It can provide access to opportunities, support, and resources, contributing to financial well-being.

The Importance of Household Assets

Understanding the various types of household assets is essential for several reasons:

- Financial Security: Household assets provide a safety net against unexpected financial shocks, such as job loss, medical emergencies, or economic downturns. Having a diverse portfolio of assets can help mitigate risk and ensure financial stability.

- Wealth Accumulation: Assets serve as the foundation for wealth creation. Through appreciation, income generation, and strategic management, household assets can grow over time, providing financial security and enabling the pursuit of long-term goals.

- Access to Credit: Assets can serve as collateral for loans, providing access to financing for various purposes, such as homeownership, education, or business ventures.

- Retirement Planning: Assets play a critical role in securing a comfortable retirement. Investments, real estate, and other assets can provide a steady stream of income during retirement, ensuring financial independence.

- Intergenerational Wealth Transfer: Assets can be passed down to future generations, creating a legacy of financial security and providing opportunities for their success.

Optimizing Household Asset Management

Effective asset management is crucial for maximizing the benefits of household assets. This involves:

- Diversification: Spreading investments across different asset classes can reduce risk and enhance returns.

- Risk Management: Identifying and mitigating potential risks associated with various assets is essential for preserving wealth.

- Strategic Allocation: Determining the optimal allocation of assets based on individual financial goals, risk tolerance, and time horizon is critical.

- Regular Monitoring and Adjustment: Regularly reviewing and adjusting asset allocation to reflect changing market conditions and personal circumstances is crucial for long-term success.

FAQs on Household Assets

1. What is the most important household asset?

The most important asset varies depending on individual circumstances and goals. For many, real estate is a cornerstone of wealth, providing shelter and potential for appreciation. However, for others, human capital or financial investments may hold greater significance.

2. How can I increase my household assets?

Increasing household assets requires a multi-pronged approach, including:

- Saving and Investing: Regularly setting aside funds for investment can help grow your asset base over time.

- Building Human Capital: Investing in education, training, and professional development can enhance earning potential and increase your value as an asset.

- Acquiring Property: Purchasing real estate or other tangible assets can provide a tangible foundation for wealth accumulation.

- Generating Income: Exploring additional income streams through side hustles, investments, or entrepreneurial ventures can contribute to asset growth.

3. How do I manage my household assets effectively?

Effective asset management involves:

- Setting Financial Goals: Defining clear financial goals provides direction and motivation for asset management.

- Creating a Budget: Tracking income and expenses helps identify areas for savings and investment.

- Seeking Professional Advice: Consulting with financial advisors can provide guidance on investment strategies, risk management, and asset allocation.

- Regularly Reviewing and Adjusting: Periodically reviewing asset allocation and investment strategies ensures they align with evolving goals and market conditions.

Tips for Building a Strong Asset Base

- Start Early: Beginning to save and invest early in life allows for compounding returns and maximizes long-term wealth accumulation.

- Embrace Diversification: Spreading investments across different asset classes reduces risk and enhances potential returns.

- Control Spending: By tracking expenses and making conscious spending decisions, individuals can free up funds for savings and investment.

- Invest in Yourself: Investing in education, skills development, and health can enhance earning potential and contribute to overall wealth.

- Seek Professional Guidance: Consulting with financial advisors can provide valuable insights and strategies for effective asset management.

Conclusion

Household assets are the foundation of financial security and wealth creation. Understanding their nature, importance, and effective management is crucial for individuals and families seeking to achieve long-term financial goals. By embracing a proactive approach to asset management, individuals can build a solid foundation for financial independence, ensuring a brighter financial future for themselves and their families.

Closure

Thus, we hope this article has provided valuable insights into The Foundation of Financial Security: Understanding Household Assets. We hope you find this article informative and beneficial. See you in our next article!