The Power of Liquidity: Understanding and Utilizing Liquid Assets

Related Articles: The Power of Liquidity: Understanding and Utilizing Liquid Assets

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Power of Liquidity: Understanding and Utilizing Liquid Assets. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Power of Liquidity: Understanding and Utilizing Liquid Assets

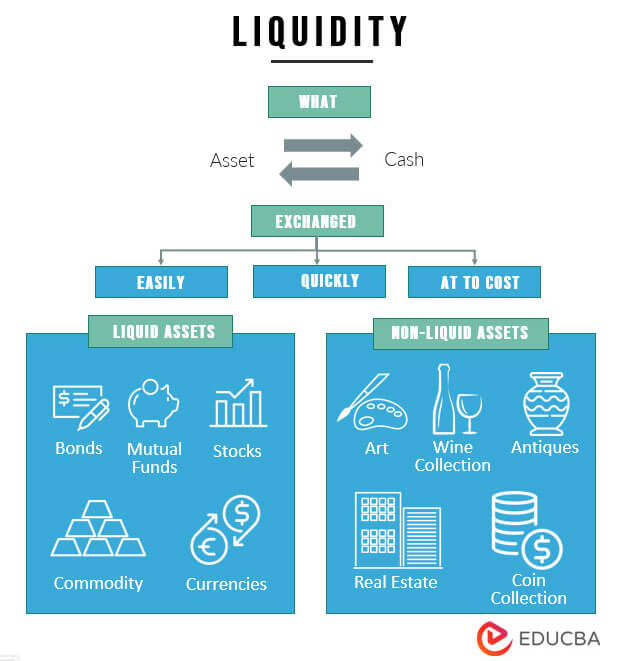

In the financial world, the term "liquidity" refers to the ease with which an asset can be converted into cash without significant loss of value. Liquid assets are essential for individuals, businesses, and even governments, providing a crucial buffer against unexpected expenses, funding opportunities, and overall financial stability.

Defining Liquid Assets

A liquid asset is one that can be readily bought or sold on an open market, with minimal impact on its price. This implies that the asset is:

- Marketable: Easily bought and sold in a timely manner.

- Tradeable: Can be exchanged for cash without significant delay.

- Price Stable: Maintains its value or experiences minimal fluctuations during the conversion process.

Types of Liquid Assets

While the concept of liquidity is straightforward, its practical application encompasses a wide range of assets, each with its own characteristics and benefits:

1. Cash and Cash Equivalents:

- Cash: The most liquid asset, readily available for immediate use.

- Checking and Savings Accounts: Accessible via bank withdrawals or electronic transfers.

- Money Market Accounts: Offer higher interest rates than traditional savings accounts, with limited withdrawal restrictions.

- Certificates of Deposit (CDs): Offer fixed interest rates for a specific term, but early withdrawal may incur penalties.

2. Marketable Securities:

- Stocks: Represent ownership in a company, offering potential for capital appreciation and dividend income.

- Bonds: Debt securities issued by corporations or governments, offering fixed interest payments and principal repayment at maturity.

- Mutual Funds: Diversified investment vehicles pooling funds from multiple investors to purchase a basket of securities.

- Exchange-Traded Funds (ETFs): Similar to mutual funds, but traded on stock exchanges, providing greater flexibility.

3. Other Liquid Assets:

- Precious Metals: Gold, silver, and platinum, historically considered safe haven assets during economic uncertainty.

- Real Estate: While traditionally illiquid, certain types of real estate, such as rental properties, can generate regular income and offer potential for appreciation.

- Cryptocurrencies: Digital assets like Bitcoin and Ethereum, though highly volatile, can be traded quickly on exchanges.

The Importance of Liquidity

Maintaining a healthy level of liquidity is crucial for various reasons:

- Financial Security: Liquid assets provide a safety net against unexpected expenses, such as medical emergencies, car repairs, or job loss.

- Investment Opportunities: Liquidity allows individuals and businesses to capitalize on attractive investment opportunities when they arise.

- Debt Management: A sufficient level of liquid assets can help manage debt by providing funds for timely payments and reducing the risk of default.

- Business Operations: Liquid assets are essential for businesses to meet their short-term obligations, such as payroll, inventory, and operating expenses.

Factors Influencing Liquidity

The liquidity of an asset can be influenced by several factors:

- Market Conditions: A strong economy and active market generally lead to higher liquidity, while downturns can decrease it.

- Asset Specificity: Highly specialized assets, such as unique artwork or real estate, may be less liquid than readily available assets.

- Transaction Costs: Fees associated with buying and selling an asset can impact its overall liquidity.

- Time Horizon: Assets with a longer time horizon, like long-term bonds, may be less liquid than short-term investments.

Strategies for Maintaining Liquidity

Maintaining a suitable level of liquidity requires strategic planning and careful consideration of individual needs and goals:

- Emergency Fund: Establish a readily accessible emergency fund to cover unexpected expenses.

- Diversification: Spread investments across various asset classes to mitigate risk and enhance liquidity.

- Regular Review: Periodically review asset allocation and adjust it based on changing circumstances and market conditions.

- Financial Planning: Consult with a financial advisor to develop a comprehensive financial plan that incorporates liquidity management strategies.

FAQs on Liquid Assets

Q: What is the difference between liquid assets and illiquid assets?

A: Liquid assets can be converted to cash quickly and easily without significant loss of value, while illiquid assets are more difficult to sell quickly or may experience a substantial price drop during the conversion process. Examples of illiquid assets include real estate, collectibles, and certain types of investments.

Q: Why is it important to have a healthy level of liquidity?

A: A sufficient level of liquid assets provides financial security, allows for investment opportunities, helps manage debt, and ensures smooth business operations.

Q: How can I increase my liquidity?

A: Strategies to increase liquidity include building an emergency fund, diversifying investments, and reducing debt.

Q: What are some common mistakes people make when it comes to liquidity?

A: Common mistakes include neglecting to build an emergency fund, over-investing in illiquid assets, and failing to regularly review asset allocation.

Tips for Managing Liquid Assets

- Set clear financial goals: Define short-term and long-term financial goals to guide asset allocation and liquidity management.

- Develop a budget: Create a realistic budget to track income and expenses, allowing for informed decisions on liquid asset allocation.

- Automate savings: Set up automatic transfers from checking accounts to savings or investment accounts to ensure regular contributions.

- Review asset allocation regularly: Periodically review investment portfolios and adjust asset allocation as needed to maintain desired liquidity levels.

Conclusion

Understanding and managing liquid assets is a fundamental aspect of financial well-being. By maintaining a healthy level of liquidity, individuals and businesses can navigate unexpected challenges, seize opportunities, and achieve their financial goals. Regular review, strategic planning, and a focus on diversification are crucial elements in maximizing the benefits of liquid assets and ensuring financial stability.

:max_bytes(150000):strip_icc()/Term-Definitions_LiquidAsset-0527b522ceba4808bd4fd02e2b69c64d.jpg)

Closure

Thus, we hope this article has provided valuable insights into The Power of Liquidity: Understanding and Utilizing Liquid Assets. We appreciate your attention to our article. See you in our next article!