The Probate Process: Navigating the Distribution of Assets after Death

Related Articles: The Probate Process: Navigating the Distribution of Assets after Death

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to The Probate Process: Navigating the Distribution of Assets after Death. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Probate Process: Navigating the Distribution of Assets after Death

The death of a loved one is a difficult and emotionally charged event. Alongside the grief, however, comes the often complex and daunting task of managing their estate. This process, known as probate, involves the legal administration of the deceased’s assets, ensuring their rightful distribution according to their wishes and the law.

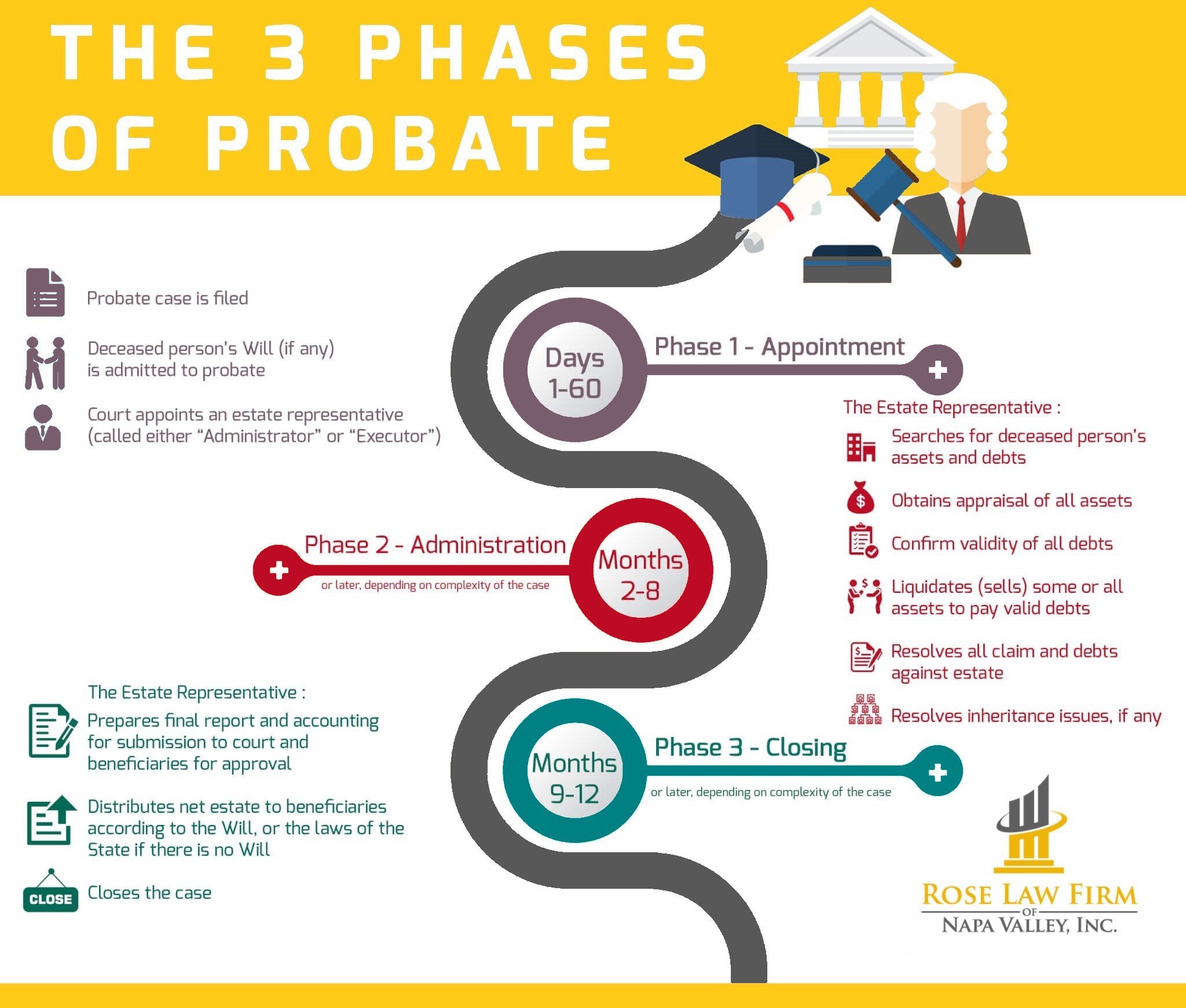

Probate is not a singular event but rather a series of legal steps that can vary in complexity depending on the size and nature of the estate. It is an essential process that ensures the orderly transfer of assets, protects beneficiaries from potential disputes, and fulfills the legal and financial obligations of the deceased.

What Assets Go Through Probate?

Not all assets are subject to probate. Some assets, such as jointly owned property or assets held in trust, pass directly to the designated beneficiary without going through the probate court. However, probate is generally required for assets held in the deceased’s individual name, including:

- Real Estate: Homes, land, and other properties owned solely by the deceased are subject to probate. This ensures that the property is properly transferred to the rightful heirs or beneficiaries.

- Bank Accounts and Investments: Savings accounts, checking accounts, stocks, bonds, and other financial instruments held in the deceased’s name are typically subject to probate.

- Personal Property: This includes tangible assets like furniture, vehicles, jewelry, artwork, and collectibles. Probate ensures the fair distribution of these items to the beneficiaries.

- Intellectual Property: Patents, copyrights, and trademarks owned by the deceased may also be subject to probate, particularly if they have significant financial value.

- Life Insurance Policies: While life insurance proceeds are typically paid directly to the named beneficiary, if the beneficiary is the estate itself, the proceeds will be subject to probate.

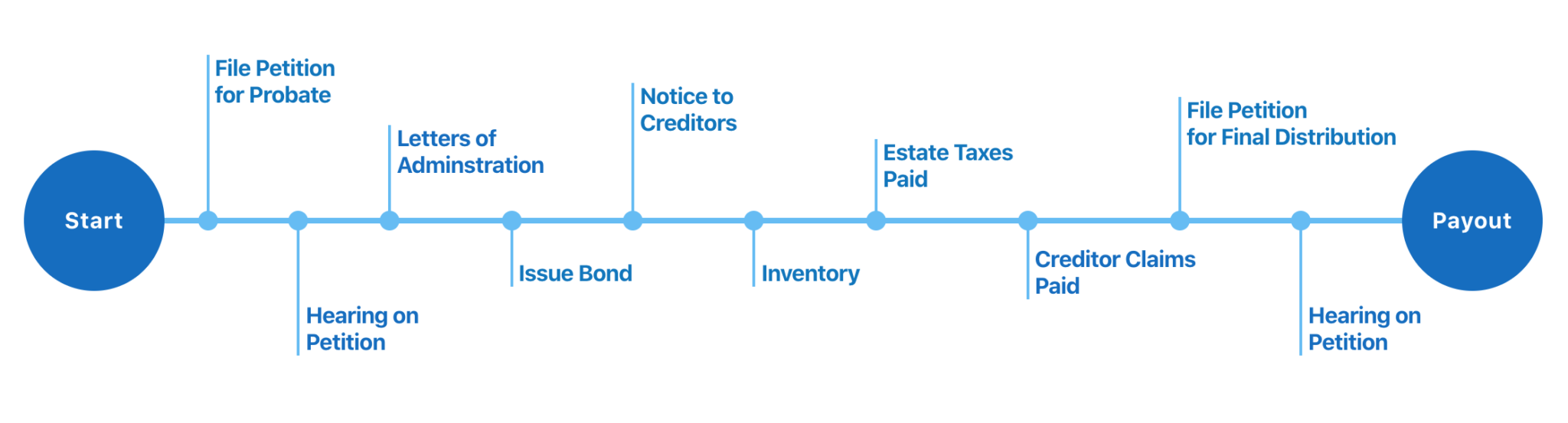

The Probate Process: A Step-by-Step Guide

The probate process typically involves the following steps:

- Opening Probate: A probate petition is filed with the court, typically by the named executor or administrator of the estate. This petition includes information about the deceased, their assets, and the desired distribution plan.

- Appointing an Executor or Administrator: The court appoints an executor if the deceased had a will, or an administrator if they did not. This individual is responsible for managing the estate, paying debts, and distributing assets according to the will or state law.

- Asset Inventory and Valuation: The executor or administrator gathers all the deceased’s assets and has them professionally appraised to determine their fair market value.

- Paying Debts and Expenses: The executor or administrator pays the deceased’s outstanding debts, including mortgages, loans, taxes, and funeral expenses.

- Distribution of Assets: Once debts are paid, the remaining assets are distributed to the beneficiaries according to the will or state law.

- Closing Probate: Once all assets are distributed and the court approves the final accounting, the probate process is officially closed.

The Importance of Probate:

Probate plays a crucial role in ensuring a smooth and legal transfer of assets after death. It provides several benefits:

- Legal Protection: Probate ensures that assets are distributed according to the deceased’s wishes, as outlined in a will, or according to state law if no will exists. This prevents potential disputes among beneficiaries and ensures that the deceased’s intentions are honored.

- Financial Transparency: The probate process requires the executor or administrator to provide a detailed accounting of the estate’s assets, debts, and distribution. This transparency helps ensure that the estate is managed responsibly and that beneficiaries receive their rightful share.

- Debt Resolution: Probate allows for the orderly payment of the deceased’s debts, ensuring that creditors are paid according to their legal rights.

- Tax Compliance: Probate ensures that the estate’s taxes are properly filed and paid, fulfilling the deceased’s legal obligations.

- **

Closure

Thus, we hope this article has provided valuable insights into The Probate Process: Navigating the Distribution of Assets after Death. We hope you find this article informative and beneficial. See you in our next article!