The Tangible And Intangible: Understanding Household Assets In The 21st Century

The Tangible and Intangible: Understanding Household Assets in the 21st Century

Related Articles: The Tangible and Intangible: Understanding Household Assets in the 21st Century

Introduction

With great pleasure, we will explore the intriguing topic related to The Tangible and Intangible: Understanding Household Assets in the 21st Century. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

The Tangible and Intangible: Understanding Household Assets in the 21st Century

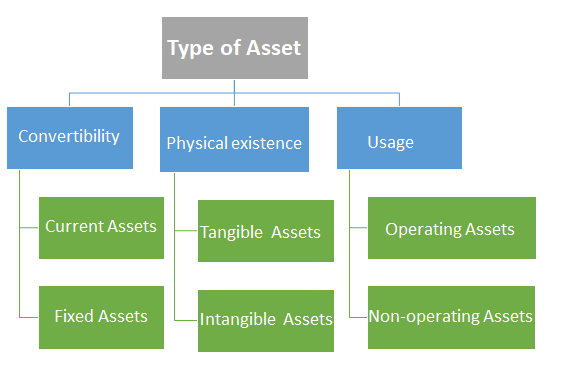

In the realm of personal finance, the concept of "assets" plays a crucial role. These assets, broadly defined, represent anything of value that an individual or household owns. While the term often conjures images of tangible possessions like houses and cars, a comprehensive understanding of household assets extends far beyond these physical items. It encompasses a broader spectrum, including intangible resources and financial instruments, each contributing to the overall financial well-being of a household.

Tangible Assets: The Cornerstones of Material Wealth

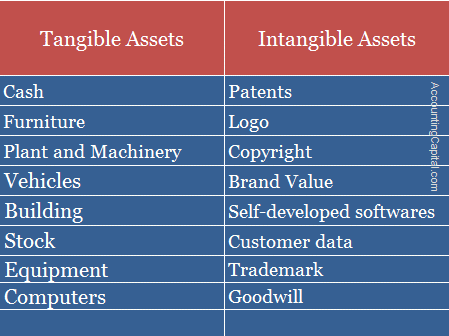

Tangible assets, as the name suggests, are physical items that have inherent value and can be touched. These assets form the foundation of traditional wealth accumulation and are often the first things that come to mind when discussing household assets.

- Real Estate: This category encompasses properties owned by the household, including primary residences, vacation homes, rental properties, and land. Real estate represents a significant portion of household wealth for many, offering potential for appreciation and rental income.

- Vehicles: Automobiles, motorcycles, boats, and other vehicles are considered tangible assets, although their value depreciates over time. The depreciation rate varies depending on the type of vehicle and its condition.

- Personal Property: This broad category includes a wide array of items, from furniture and electronics to jewelry and artwork. While individual items may have varying values, the collective value of personal property can be significant, particularly for households with valuable antiques or collections.

- Investments in Physical Assets: This category includes investments in tangible assets like precious metals, commodities, and collectibles. While these investments can offer diversification and potential for appreciation, they also carry inherent risks associated with market fluctuations and storage costs.

Intangible Assets: The Hidden Value of Knowledge and Potential

While tangible assets are readily visible and quantifiable, intangible assets represent a less tangible but equally important aspect of household wealth. These assets often derive their value from knowledge, skills, relationships, and future potential.

- Human Capital: This refers to the skills, education, and experience an individual possesses. Human capital is a valuable asset as it contributes to earning potential and career advancement.

- Intellectual Property: This category encompasses patents, copyrights, trademarks, and other forms of intellectual creations that have commercial value.

- Financial Capital: This encompasses savings, investments, and other financial instruments that hold value and generate returns. It includes stocks, bonds, mutual funds, and retirement accounts.

- Social Capital: This refers to the networks of relationships and connections an individual has. Strong social capital can lead to opportunities for collaboration, support, and information exchange, ultimately contributing to personal and professional success.

Understanding the Importance of Household Assets

Recognizing the diverse range of assets that contribute to a household’s financial well-being is crucial for several reasons:

- Financial Security: Assets provide a safety net and a cushion against unexpected financial emergencies. A diverse portfolio of assets can help mitigate risks and ensure financial stability.

- Wealth Accumulation: Assets can appreciate in value over time, allowing for wealth accumulation and financial growth.

- Income Generation: Some assets, such as rental properties and investments, can generate passive income, providing a source of revenue beyond employment.

- Retirement Planning: Assets play a vital role in securing financial independence during retirement. A robust asset portfolio can provide a steady stream of income and ensure a comfortable lifestyle after leaving the workforce.

FAQs: Delving Deeper into Household Assets

1. Are all assets equally valuable?

No, assets vary in their value and liquidity. Some assets, like real estate, tend to be less liquid, meaning they cannot be easily converted to cash. Other assets, like stocks and bonds, are more liquid and can be readily traded.

2. How are assets valued?

The valuation of assets depends on their type and market conditions. Real estate is typically valued by professional appraisers, while financial assets are valued based on their market price. Personal property is often valued based on its replacement cost or its estimated resale value.

3. Can assets be liabilities?

While assets are generally considered to be beneficial, some assets can become liabilities if they incur significant expenses or generate losses. For example, a rental property that requires extensive repairs or fails to attract tenants could become a financial burden.

4. How can I track my assets?

It is essential to maintain a comprehensive record of all household assets. This can be achieved through spreadsheets, personal finance software, or financial advisors. Regular tracking and updates ensure accurate financial planning and decision-making.

5. How do taxes affect assets?

Different types of assets are subject to varying tax implications. For example, capital gains from selling investments are taxable, while the sale of a primary residence may qualify for tax exemptions. Understanding the tax implications of different assets is crucial for effective financial planning.

Tips for Managing Household Assets Effectively

- Diversify your asset portfolio: Spread your investments across different asset classes, such as stocks, bonds, real estate, and commodities, to mitigate risks and maximize returns.

- Regularly review and adjust your portfolio: Market conditions and personal circumstances can change over time, necessitating adjustments to your asset allocation.

- Seek professional advice: Consult with a financial advisor to develop a personalized asset management strategy aligned with your financial goals and risk tolerance.

- Invest in your human capital: Continuously invest in your education, skills, and professional development to enhance your earning potential and future prospects.

- Protect your assets: Ensure adequate insurance coverage for your tangible assets to mitigate the financial impact of unforeseen events like accidents, theft, or natural disasters.

Conclusion: A Foundation for Financial Well-being

Understanding the diverse nature of household assets is essential for building a solid financial foundation. By recognizing the value of both tangible and intangible assets, individuals and households can make informed financial decisions, manage their resources effectively, and work towards achieving their financial goals. A well-managed asset portfolio can provide financial security, facilitate wealth accumulation, and pave the way for a brighter financial future.

Closure

Thus, we hope this article has provided valuable insights into The Tangible and Intangible: Understanding Household Assets in the 21st Century. We hope you find this article informative and beneficial. See you in our next article!