Understanding Household Assets: A Guide to Building Wealth and Security

Related Articles: Understanding Household Assets: A Guide to Building Wealth and Security

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding Household Assets: A Guide to Building Wealth and Security. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Household Assets: A Guide to Building Wealth and Security

Household assets represent the tangible and intangible possessions that contribute to a household’s financial well-being and overall security. They are the building blocks of a family’s economic strength, providing a foundation for future growth and stability. Understanding these assets and their significance is crucial for individuals and families seeking to manage their finances effectively and build a secure future.

Defining Household Assets:

Household assets can be categorized into two primary groups:

1. Tangible Assets: These are physical possessions that hold intrinsic value and can be bought, sold, or traded. They include:

- Real Estate: This encompasses land and any structures built on it, such as houses, apartments, commercial buildings, and vacant land. Real estate is a significant asset for many households, offering potential for appreciation in value and rental income.

- Vehicles: Cars, trucks, motorcycles, and other vehicles are considered assets, particularly if they are in good condition and hold resale value. However, it’s important to note that vehicles depreciate rapidly, and their value can fluctuate based on market conditions and maintenance.

- Personal Property: This includes items such as furniture, electronics, jewelry, artwork, and collectibles. While these assets may not hold significant monetary value, they contribute to a household’s overall wealth and can be valuable in times of need.

- Investments: This category encompasses a wide range of financial instruments, including stocks, bonds, mutual funds, and exchange-traded funds (ETFs). These investments offer the potential for growth and diversification, helping to build wealth over time.

- Cash and Cash Equivalents: This includes readily accessible funds in bank accounts, savings accounts, and money market accounts. While not offering substantial growth potential, these assets provide liquidity and security for immediate needs.

2. Intangible Assets: These assets are not physical possessions but represent valuable rights, knowledge, or capabilities. They include:

- Human Capital: This refers to the skills, knowledge, and experience an individual possesses. A highly skilled and educated workforce contributes significantly to a household’s earning potential and overall well-being.

- Intellectual Property: This encompasses patents, trademarks, copyrights, and other forms of intellectual creations. While intangible, these assets can generate significant revenue through licensing or commercialization.

- Social Capital: This refers to the network of relationships and connections an individual or household possesses. A strong social network can provide valuable support, resources, and opportunities.

- Financial Literacy: Understanding personal finance principles, budgeting, investing, and managing debt is an invaluable intangible asset. Financial literacy empowers individuals to make informed financial decisions and build a secure future.

Benefits of Understanding and Managing Household Assets:

Recognizing and managing household assets effectively offers several benefits:

- Financial Security: A strong asset base provides a safety net against unexpected expenses, economic downturns, or emergencies. It ensures financial stability and reduces reliance on debt.

- Wealth Accumulation: By strategically managing and investing assets, households can build wealth over time, enabling them to achieve financial goals such as retirement planning, education funding, or homeownership.

- Improved Creditworthiness: A healthy asset-to-debt ratio can improve creditworthiness, making it easier to secure loans at favorable rates.

- Enhanced Quality of Life: Possessing valuable assets can contribute to a higher quality of life, providing access to better housing, healthcare, education, and leisure activities.

- Generational Wealth Transfer: By strategically planning and managing assets, households can transfer wealth to future generations, ensuring financial security and opportunity for their families.

FAQs on Household Assets:

Q: What is the difference between assets and liabilities?

A: Assets are possessions that contribute to a household’s wealth, while liabilities represent debts or obligations. Assets increase net worth, while liabilities decrease it.

Q: How can I determine the value of my household assets?

A: The value of tangible assets can be determined through market research, appraisals, or consultations with professionals. Intangible assets are more difficult to quantify but can be assessed based on their potential income-generating capacity or contribution to overall well-being.

Q: How can I manage my household assets effectively?

A: Effective asset management involves:

- Tracking and Monitoring: Regularly reviewing and updating asset values.

- Diversification: Spreading investments across different asset classes to mitigate risk.

- Risk Management: Assessing and managing potential risks associated with different assets.

- Financial Planning: Developing a comprehensive financial plan that aligns with individual goals and circumstances.

Q: How can I protect my household assets?

A: Asset protection strategies include:

- Insurance: Obtaining appropriate insurance coverage for real estate, vehicles, and personal property.

- Estate Planning: Establishing wills, trusts, and other legal documents to ensure assets are distributed according to your wishes.

- Secure Storage: Safeguarding valuable assets from theft, damage, or loss.

Tips for Managing Household Assets:

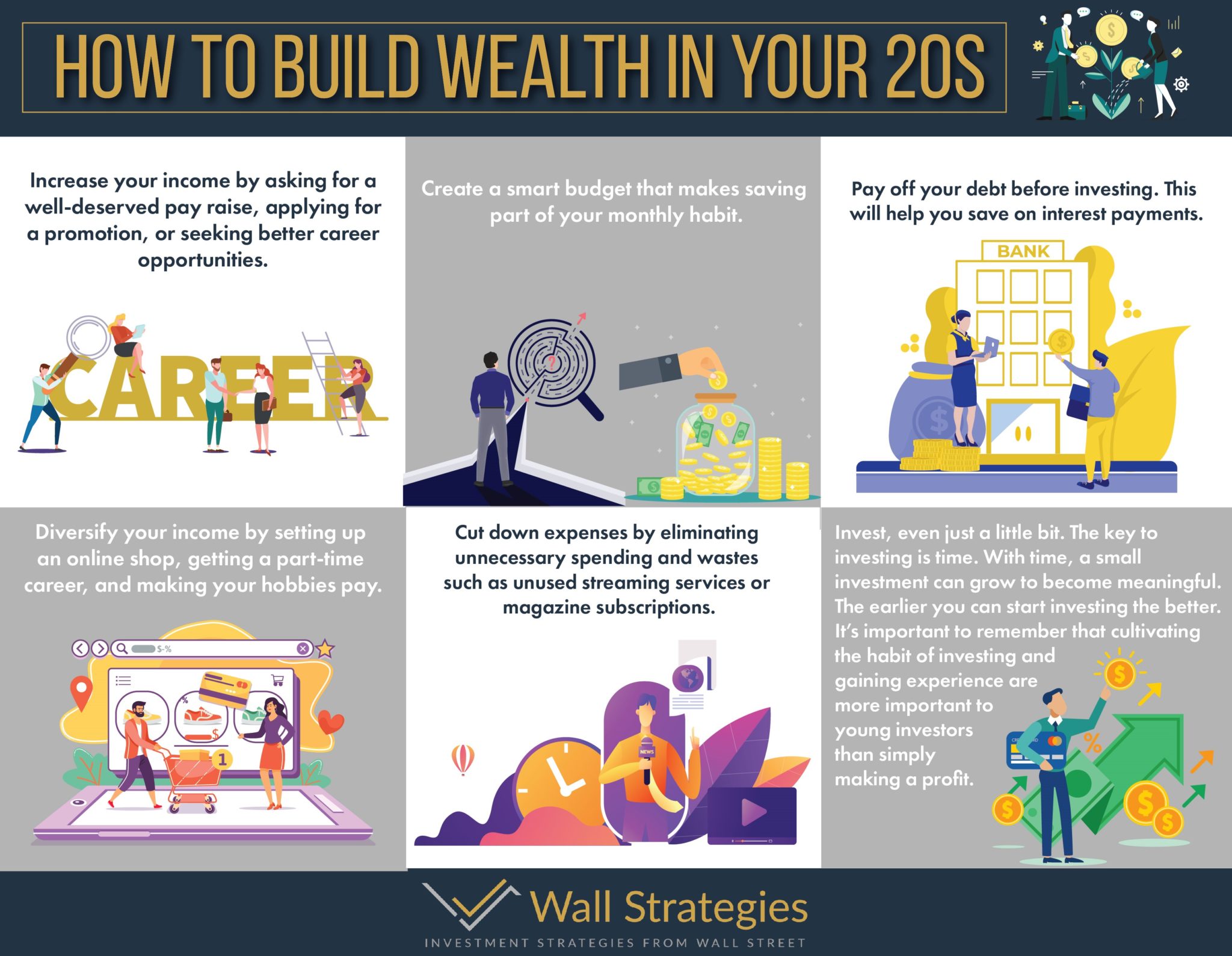

- Develop a Budget: Track income and expenses to understand spending patterns and identify areas for improvement.

- Set Financial Goals: Define short-term and long-term financial objectives, such as saving for retirement, paying off debt, or purchasing a home.

- Seek Professional Advice: Consult with financial advisors, accountants, or estate planning attorneys for personalized guidance.

- Stay Informed: Keep abreast of financial market trends, investment opportunities, and changes in tax laws.

- Regularly Review and Adjust: Evaluate asset allocation and financial strategies periodically to ensure alignment with changing circumstances and goals.

Conclusion:

Understanding and managing household assets is fundamental to building financial security, accumulating wealth, and achieving long-term financial goals. By recognizing the various forms of assets, their benefits, and strategies for effective management, individuals and families can empower themselves to build a strong financial foundation and secure a prosperous future.

![How to Build Generational Wealth [All You Need to Know]](https://ofdollarsanddata.com/wp-content/uploads/2023/02/visualcapitalist_assets-net-worth.jpeg)

Closure

Thus, we hope this article has provided valuable insights into Understanding Household Assets: A Guide to Building Wealth and Security. We thank you for taking the time to read this article. See you in our next article!