Understanding Liquid Assets: The Cornerstone of Financial Flexibility

Related Articles: Understanding Liquid Assets: The Cornerstone of Financial Flexibility

Introduction

With great pleasure, we will explore the intriguing topic related to Understanding Liquid Assets: The Cornerstone of Financial Flexibility. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Liquid Assets: The Cornerstone of Financial Flexibility

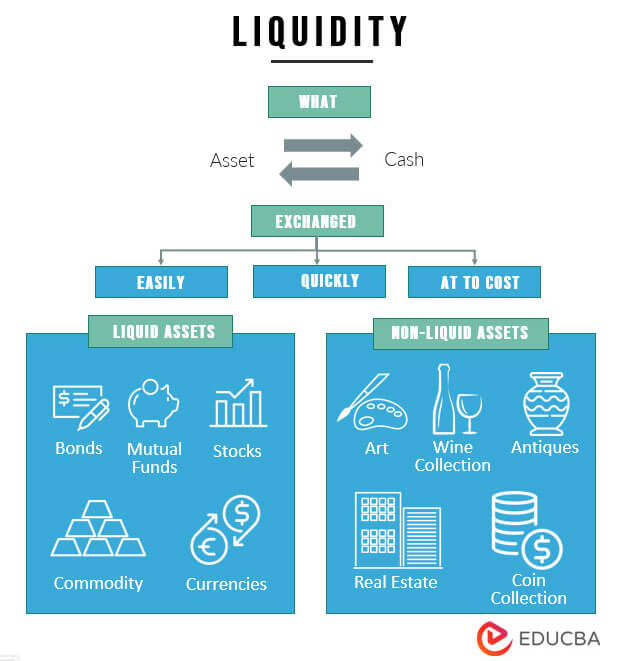

In the realm of personal finance, the concept of "liquid assets" holds significant weight. It represents the portion of an individual’s or entity’s financial holdings that can be readily converted into cash without substantial loss of value or time. Understanding what constitutes liquid assets is crucial for individuals and businesses alike, as it forms the foundation for financial stability, flexibility, and preparedness for unforeseen circumstances.

Defining Liquid Assets: A Spectrum of Accessibility

The defining characteristic of liquid assets is their ease of conversion into cash. This spectrum of liquidity ranges from highly liquid assets, such as cash and certain types of investments, to less liquid assets, such as real estate or physical assets.

Highly Liquid Assets:

- Cash: The most liquid asset, readily available for immediate use. This includes physical cash, checking accounts, and savings accounts.

- Money Market Accounts: These accounts offer higher interest rates than traditional savings accounts while maintaining high liquidity, allowing for easy access to funds.

- Certificates of Deposit (CDs): While CDs offer higher interest rates than savings accounts, they typically have fixed terms and penalties for early withdrawal, reducing their liquidity.

- Treasury Bills (T-Bills): Short-term government debt securities with maturities of less than a year, offering a low-risk investment option with high liquidity.

- Short-Term Bonds: Bonds with maturities under one year, providing higher potential returns than T-Bills but with slightly lower liquidity.

Moderately Liquid Assets:

- Mutual Funds and Exchange-Traded Funds (ETFs): These pooled investment vehicles offer diversification and liquidity, although selling them might incur transaction fees and market fluctuations.

- Stocks: While publicly traded stocks can be readily sold, their market value is subject to volatility, impacting their liquidity.

- Annuities: These financial products offer a stream of income over time, but their liquidity can be restricted depending on the specific contract terms.

Less Liquid Assets:

- Real Estate: Property can be difficult to sell quickly and may require significant time and cost to liquidate, making it less liquid.

- Physical Assets: Collectibles, jewelry, and artwork can be difficult to value and sell, making them less liquid.

- Private Equity Investments: Investments in private companies are generally illiquid, requiring significant time and effort to convert into cash.

The Importance of Liquid Assets:

Liquid assets serve as a vital buffer in the face of unforeseen circumstances, providing financial flexibility and stability. They are essential for:

- Meeting Emergencies: Liquid assets ensure you can cover unexpected expenses, such as medical bills, car repairs, or job loss.

- Seizing Opportunities: Having readily available cash allows you to take advantage of unexpected opportunities, such as buying a discounted property or investing in a promising venture.

- Managing Debt: Liquid assets can be used to pay off high-interest debt, reducing financial burden and improving overall financial health.

- Retirement Planning: A healthy pool of liquid assets can provide a safety net for retirement, allowing for flexibility in spending and investment strategies.

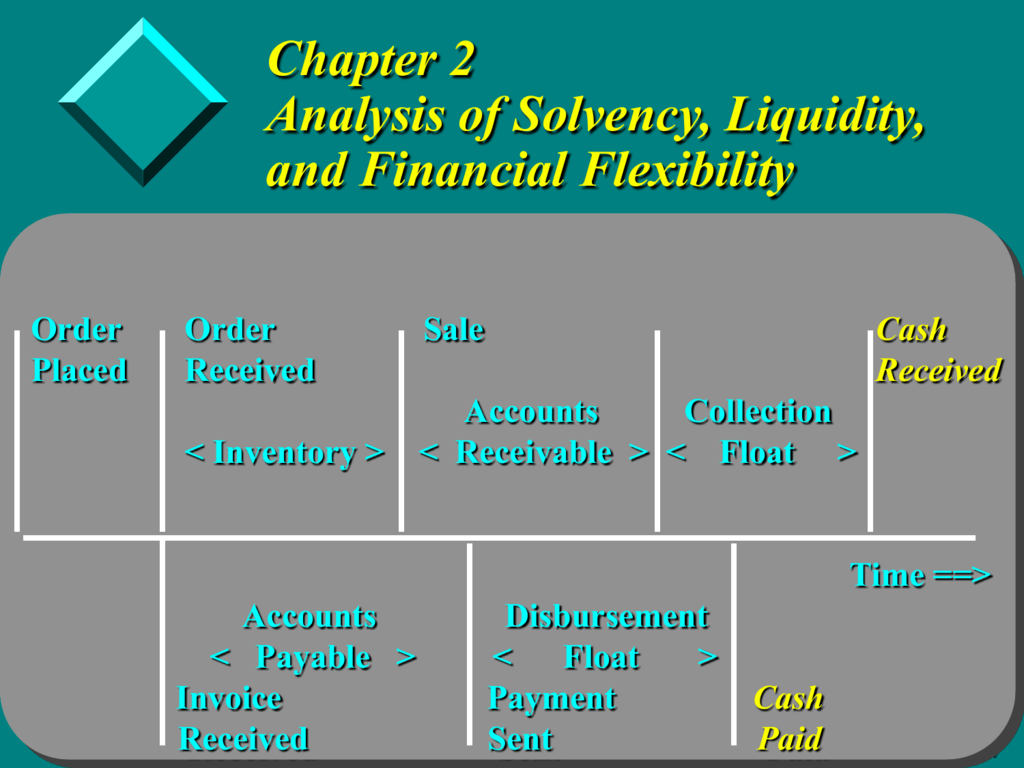

- Business Operations: Businesses rely on liquid assets to cover operating expenses, manage inventory, and finance growth initiatives.

Factors Influencing Liquidity:

The liquidity of an asset is not solely determined by its inherent nature. Several factors can influence its ease of conversion into cash:

- Market Conditions: Market volatility can impact the value and liquidity of assets, especially those traded on public exchanges.

- Time Constraints: The time required to sell an asset and receive cash can significantly impact its liquidity.

- Transaction Costs: Fees associated with selling an asset, such as brokerage commissions or legal fees, can reduce its overall liquidity.

- Asset Specificity: Highly specialized assets, such as unique collectibles or real estate with specific features, can be more challenging to sell, reducing their liquidity.

Frequently Asked Questions:

1. What is the minimum amount of liquid assets I should have?

There is no one-size-fits-all answer, as the ideal amount of liquid assets depends on individual circumstances, including income, expenses, debt levels, and risk tolerance. A general guideline is to have three to six months’ worth of living expenses readily available.

2. How do I increase my liquid assets?

- Reduce spending: Identify areas where you can cut back on discretionary spending.

- Increase income: Explore ways to boost your income, such as taking on a side hustle or asking for a raise.

- Pay down debt: Prioritize paying off high-interest debt to free up cash flow.

- Invest wisely: Consider investing in liquid assets, such as money market accounts or short-term bonds, to grow your savings.

3. Are all liquid assets created equal?

No, not all liquid assets are created equal. While cash is the most liquid, other assets, such as money market accounts and T-Bills, offer higher returns with minimal risk to liquidity. However, assets like stocks and real estate can be more volatile and may require more time and effort to convert into cash.

4. What are the risks associated with liquid assets?

While liquid assets offer flexibility, they also come with some risks:

- Inflation: The value of cash can erode over time due to inflation.

- Interest Rate Risk: Interest rates can fluctuate, impacting the returns on liquid assets such as savings accounts and money market accounts.

- Opportunity Cost: Holding cash or highly liquid assets can result in lower potential returns compared to investments with higher risk.

5. How do I manage my liquid assets effectively?

- Track your spending: Monitor your income and expenses to understand your cash flow and identify areas for improvement.

- Set financial goals: Establish clear financial objectives, such as saving for a down payment, retirement, or an emergency fund.

- Diversify your portfolio: Don’t put all your eggs in one basket. Diversify your investments across different asset classes to reduce risk.

- Review your portfolio regularly: Periodically assess your investment strategy and make adjustments based on your financial goals, risk tolerance, and market conditions.

Tips for Building a Strong Liquid Asset Position:

- Automate savings: Set up automatic transfers from your checking account to a savings or investment account to ensure consistent contributions.

- Negotiate lower interest rates: Explore options to reduce interest rates on existing debt, freeing up cash flow for savings.

- Create a budget: Develop a realistic budget that tracks your income and expenses, helping you identify areas for savings.

- Seek professional advice: Consult with a financial advisor to develop a personalized financial plan that considers your individual needs and goals.

Conclusion:

Liquid assets are the bedrock of financial stability and flexibility. By understanding the different types of liquid assets, their benefits, and the factors influencing their liquidity, individuals and businesses can make informed decisions to build a strong financial foundation. Having a sufficient amount of readily available cash allows for navigating unexpected circumstances, seizing opportunities, and achieving long-term financial goals. Maintaining a healthy balance between liquid assets and other investments is key to achieving financial security and peace of mind.

Closure

Thus, we hope this article has provided valuable insights into Understanding Liquid Assets: The Cornerstone of Financial Flexibility. We thank you for taking the time to read this article. See you in our next article!