Understanding the Power of Home Value Calculators: A Comprehensive Guide

Related Articles: Understanding the Power of Home Value Calculators: A Comprehensive Guide

Introduction

In this auspicious occasion, we are delighted to delve into the intriguing topic related to Understanding the Power of Home Value Calculators: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding the Power of Home Value Calculators: A Comprehensive Guide

In the dynamic world of real estate, making informed decisions hinges on accurate information. One tool that has emerged as a valuable asset for both homeowners and prospective buyers is the home value calculator. These online tools, often provided by real estate websites, utilize various data points to estimate the current market value of a property. This article delves into the intricacies of home value calculators, examining their functionalities, benefits, and limitations, ultimately highlighting their importance in navigating the complex landscape of real estate.

The Mechanics of Home Value Calculators: A Deep Dive

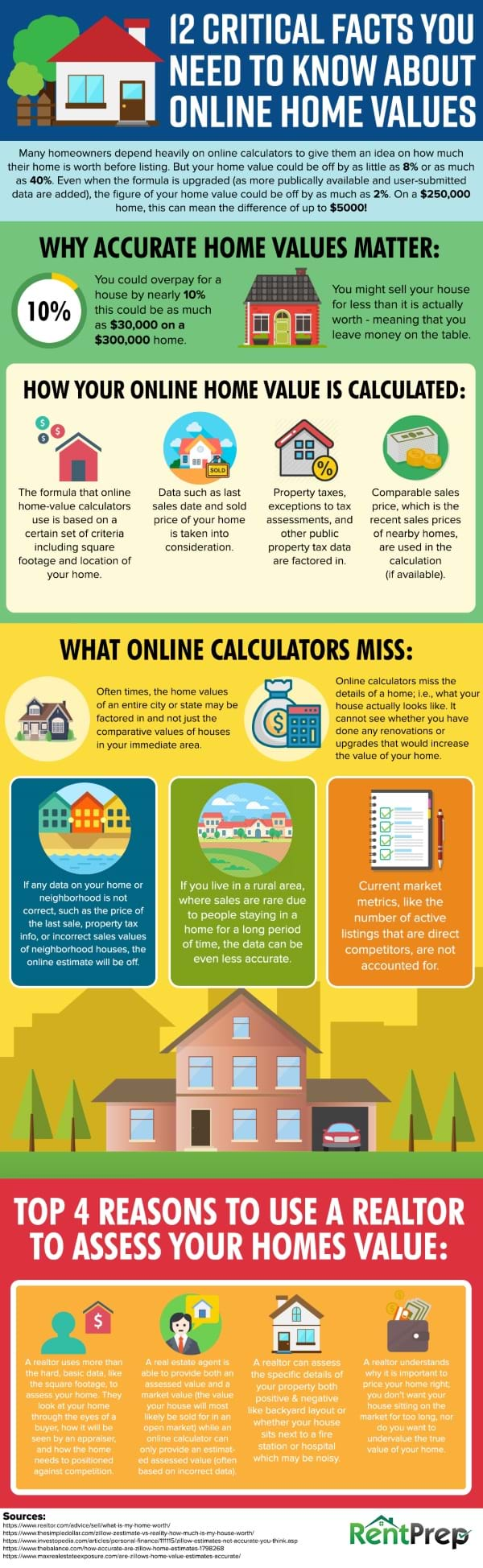

Home value calculators function by employing a range of algorithms and data points to generate an estimated value. The key elements that influence their calculations include:

- Property Details: The calculator requires basic information about the property, such as its address, size (square footage), number of bedrooms and bathrooms, and the presence of specific features like a garage or swimming pool.

- Location Data: The tool considers the property’s location, taking into account factors like neighborhood demographics, school districts, crime rates, proximity to amenities, and local market trends.

- Comparative Market Analysis (CMA): Many calculators draw upon data from recent sales of comparable properties in the surrounding area. This helps to establish a benchmark for the subject property’s value.

- Public Records: Access to public records, such as property tax assessments and sales history, provides valuable insights into the property’s value trajectory.

- Economic Indicators: The calculator might also factor in broader economic indicators like interest rates, inflation, and local economic activity, as these can influence property values.

Benefits of Utilizing Home Value Calculators:

-

Empowering Homeowners: Home value calculators provide homeowners with a quick and convenient way to gauge the potential worth of their property. This information can be invaluable when considering refinancing, selling, or simply understanding the current market value of their investment.

-

Assisting Prospective Buyers: For those seeking to purchase a home, these calculators offer a preliminary estimate of a property’s value. This allows potential buyers to assess the feasibility of their budget and make informed decisions about which properties to pursue.

-

Market Insights: Home value calculators provide a snapshot of the current real estate market in a specific area. By observing trends in estimated values, individuals can gain a better understanding of market fluctuations, supply and demand, and potential investment opportunities.

-

Transparency and Accessibility: These calculators are widely available online, offering free and easy access to real estate information. This transparency empowers individuals to conduct their own research and avoid relying solely on professional valuations, which can be costly.

Limitations and Considerations:

While home value calculators offer valuable insights, it’s crucial to understand their limitations:

-

Estimates, Not Guarantees: The estimates generated by these tools are not definitive valuations. They are merely approximations based on available data, and actual market values can vary significantly.

-

Data Accuracy: The accuracy of the calculator’s estimates depends on the quality and completeness of the data used. Outdated or incomplete information can lead to inaccurate valuations.

-

Lack of Professional Expertise: Home value calculators cannot replace the expertise of a qualified real estate appraiser. Appraisers conduct thorough inspections and consider a wider range of factors, providing a more comprehensive and accurate valuation.

-

Market Volatility: Real estate markets are dynamic and constantly evolving. The estimated value generated by a calculator at a specific point in time may not reflect the true market value a few months later.

FAQs about Home Value Calculators:

1. Are home value calculators accurate?

Home value calculators provide estimates, not guarantees. The accuracy of the estimates depends on the quality of the data used, the sophistication of the algorithms, and the specific market conditions. It’s essential to treat these estimates as a starting point for further research and professional valuation if necessary.

2. What are the best home value calculators available?

Several reputable websites offer home value calculators, including Zillow, Redfin, Trulia, and Realtor.com. The accuracy of these calculators can vary depending on the specific location and the quality of their data sources.

3. How often should I use a home value calculator?

It’s recommended to use a home value calculator periodically to track changes in your property’s estimated value. This is particularly important if you are considering selling your home or refinancing your mortgage.

4. Can I rely on a home value calculator for a home sale?

While a home value calculator can provide an initial estimate, it should not be used as the sole basis for determining a selling price. A professional real estate agent can conduct a comprehensive Comparative Market Analysis (CMA) and provide a more accurate valuation based on local market conditions.

5. What factors can influence the accuracy of a home value calculator?

The accuracy of a home value calculator can be influenced by:

- Data quality and completeness: Outdated or incomplete data can lead to inaccurate estimates.

- Market conditions: Fluctuations in the real estate market can impact the accuracy of estimates.

- Property specifics: Unique features or renovations that are not included in the calculator’s data can affect the accuracy.

- Algorithm sophistication: The algorithms used by different calculators can vary in their complexity and accuracy.

Tips for Using Home Value Calculators Effectively:

- Use multiple calculators: Compare estimates from different sources to get a more comprehensive picture of your property’s potential value.

- Verify data accuracy: Double-check the information you provide to the calculator and ensure it is accurate and up-to-date.

- Consider local market trends: Research recent sales in your area to gain a better understanding of the local market.

- Consult a professional: If you need a more precise valuation, consult a qualified real estate appraiser.

- Stay informed: Keep abreast of market trends and economic indicators that can affect property values.

Conclusion:

Home value calculators are a valuable tool for gaining insights into the potential worth of a property. They offer a convenient and accessible way to understand market trends, compare properties, and make informed decisions. However, it’s crucial to remember that these tools provide estimates, not guarantees, and should be used in conjunction with other resources and professional expertise when making significant real estate decisions. By understanding the strengths and limitations of home value calculators, individuals can leverage their power to navigate the complex world of real estate with greater confidence and informed choices.

Closure

Thus, we hope this article has provided valuable insights into Understanding the Power of Home Value Calculators: A Comprehensive Guide. We thank you for taking the time to read this article. See you in our next article!