Understanding Your Financial Foundation: A Comprehensive Guide To Household Assets

Understanding Your Financial Foundation: A Comprehensive Guide to Household Assets

Related Articles: Understanding Your Financial Foundation: A Comprehensive Guide to Household Assets

Introduction

With enthusiasm, let’s navigate through the intriguing topic related to Understanding Your Financial Foundation: A Comprehensive Guide to Household Assets. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

Understanding Your Financial Foundation: A Comprehensive Guide to Household Assets

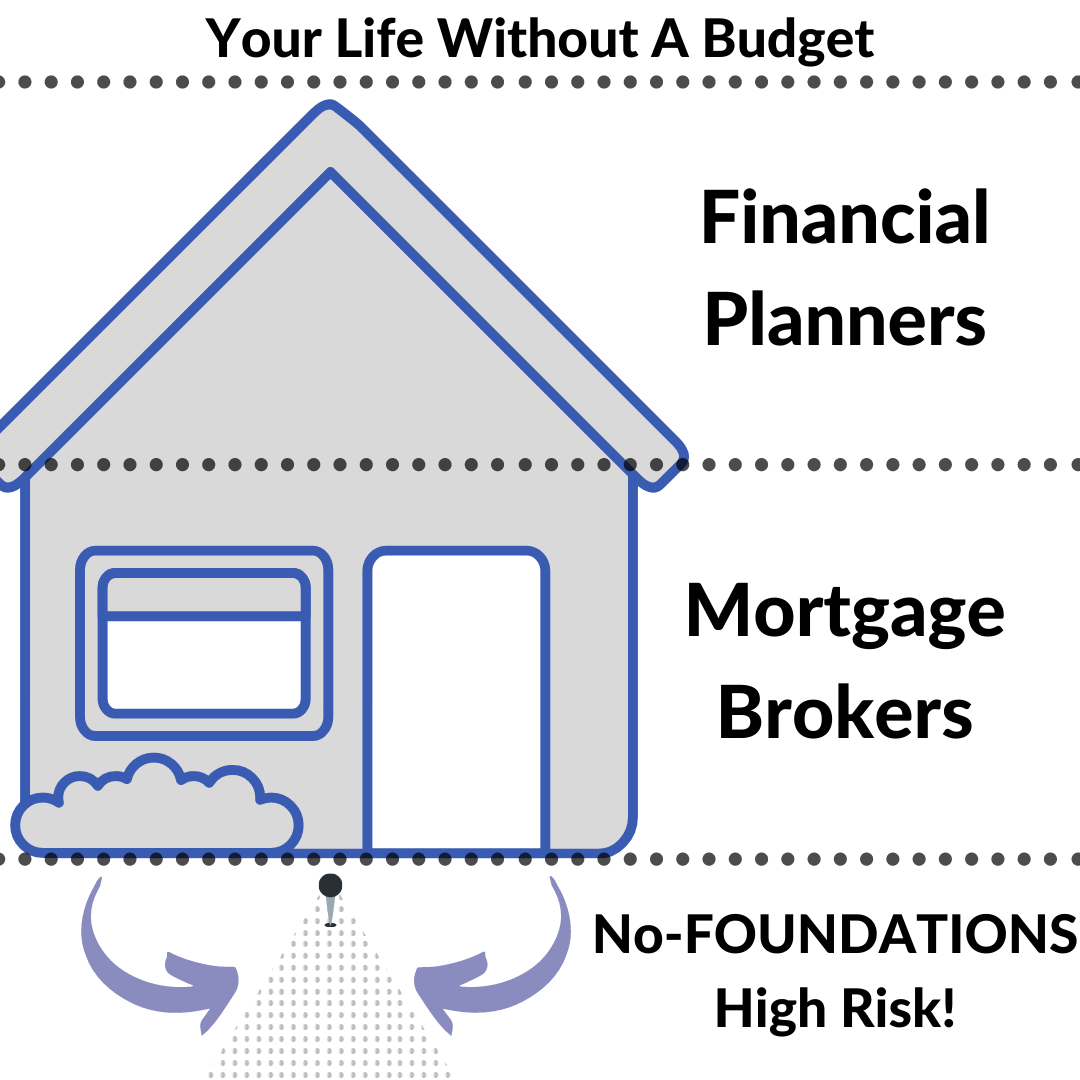

In the realm of personal finance, understanding your assets is paramount. These assets represent the tangible and intangible resources you own, forming the bedrock of your financial well-being. A comprehensive list of household assets provides a clear picture of your financial standing, enabling informed decision-making regarding investments, debt management, and future planning.

Defining Household Assets:

Household assets encompass all items of value owned by an individual or a family. These assets can be broadly categorized into two primary groups:

1. Tangible Assets: These are physical possessions with inherent value. They can be further classified as:

- Real Estate: This category includes properties such as homes, apartments, land, and commercial buildings. Real estate often serves as a significant investment and provides shelter.

- Vehicles: Automobiles, motorcycles, boats, and other forms of transportation are tangible assets. Their value depreciates over time, but they offer essential mobility and convenience.

- Personal Property: This broad category encompasses a wide range of possessions, including furniture, electronics, jewelry, artwork, and collectibles. These assets may hold sentimental value or represent potential investment opportunities.

- Cash and Cash Equivalents: This includes readily accessible funds in bank accounts, savings accounts, money market accounts, and short-term investments like certificates of deposit (CDs).

2. Intangible Assets: These assets lack physical form but hold economic value. They are often associated with intellectual property or financial instruments:

- Investments: This category includes stocks, bonds, mutual funds, exchange-traded funds (ETFs), and real estate investment trusts (REITs). These assets represent ownership in companies or financial instruments with the potential for growth and income generation.

- Retirement Accounts: These are specialized accounts designed for saving for retirement. Examples include 401(k)s, 403(b)s, IRAs, and Roth IRAs. These accounts often offer tax advantages and are essential for long-term financial security.

- Intellectual Property: This category includes patents, trademarks, copyrights, and other forms of intellectual creations. These assets can be valuable for businesses and individuals, generating revenue through licensing, royalties, or other forms of exploitation.

The Importance of a Comprehensive Asset List:

Creating a detailed list of household assets offers several key benefits:

- Financial Clarity: A comprehensive asset list provides a clear overview of your financial holdings, allowing you to understand your overall financial position.

- Investment Planning: By understanding your existing assets, you can identify potential areas for investment diversification or growth.

- Debt Management: An asset list helps you assess your debt-to-asset ratio, enabling informed decisions regarding debt repayment strategies.

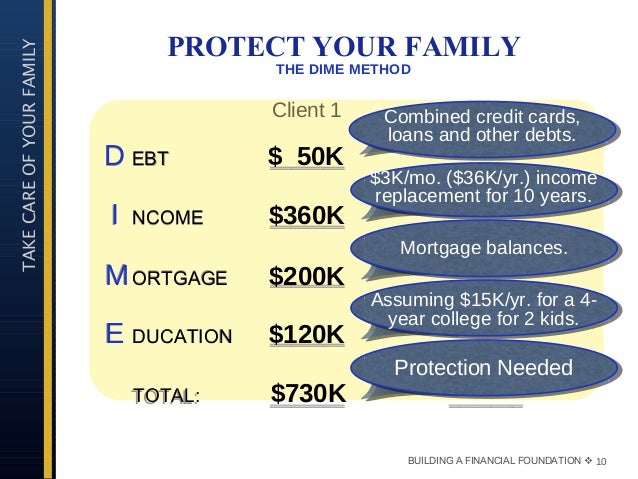

- Financial Planning: A comprehensive asset list is crucial for developing long-term financial plans, including retirement planning, estate planning, and insurance needs.

- Emergency Preparedness: In case of emergencies, having a detailed asset list can expedite insurance claims and help you recover lost assets.

Creating Your Household Asset List:

To create a thorough and informative asset list, follow these steps:

- Gather Information: Collect all relevant documents, including bank statements, investment account statements, property deeds, insurance policies, and vehicle titles.

- Categorize Assets: Organize your assets based on the categories outlined above.

- Determine Current Value: For each asset, estimate its current market value. This may require consulting with professionals, such as real estate agents or financial advisors, for accurate valuations.

- Document Ownership: Clearly indicate the ownership structure for each asset. This is particularly important for shared assets, such as joint bank accounts or properties held in trust.

- Regularly Update: Ensure your asset list is updated periodically to reflect changes in ownership, value, or additions.

Examples of Household Assets:

To illustrate the concept of household assets, consider these examples:

-

Tangible Assets:

- Real Estate: A single-family home, a vacation property, a rental apartment building

- Vehicles: A car, a motorcycle, a boat, a recreational vehicle (RV)

- Personal Property: Furniture, electronics, jewelry, artwork, collectibles, musical instruments

- Cash and Cash Equivalents: Savings account, checking account, money market account, certificate of deposit (CD)

-

Intangible Assets:

- Investments: Stocks, bonds, mutual funds, ETFs, REITs

- Retirement Accounts: 401(k), 403(b), IRA, Roth IRA

- Intellectual Property: Patents, trademarks, copyrights

FAQs Regarding Household Assets:

1. What is the best way to track my assets?

There are several methods for tracking assets:

- Spreadsheet: A simple spreadsheet can effectively organize and track asset information.

- Financial Software: Personal finance software programs offer features for managing assets, tracking investments, and generating reports.

- Online Asset Tracking Platforms: Several websites and apps specialize in asset tracking, providing tools for valuation, reporting, and analysis.

2. Should I include debt in my asset list?

While debt is not an asset, it’s crucial to consider it alongside your assets to gain a comprehensive understanding of your financial situation. Debt can impact your net worth and influence your financial planning decisions.

3. How often should I update my asset list?

It’s recommended to update your asset list at least annually or more frequently if there are significant changes in your financial situation, such as major purchases, investments, or debt repayments.

4. What happens to my assets after I die?

The disposition of your assets after your death is governed by your estate plan. This plan should specify how your assets will be distributed to your beneficiaries.

Tips for Managing Household Assets:

- Diversify: Avoid putting all your eggs in one basket. Diversify your investments across different asset classes to mitigate risk.

- Review Regularly: Periodically review your asset allocation and make adjustments as needed to align with your financial goals.

- Seek Professional Advice: Consult with financial advisors or other professionals for expert guidance on managing your assets.

- Protect Your Assets: Ensure your assets are adequately insured against potential losses due to theft, damage, or other unforeseen events.

Conclusion:

Creating and maintaining a comprehensive household asset list is an essential step towards achieving financial well-being. It provides clarity, facilitates informed decision-making, and lays the foundation for sound financial planning. By understanding your assets and managing them effectively, you can build a solid financial foundation for yourself and your family.

Closure

Thus, we hope this article has provided valuable insights into Understanding Your Financial Foundation: A Comprehensive Guide to Household Assets. We hope you find this article informative and beneficial. See you in our next article!