Valuing Household Items for Probate: A Comprehensive Guide

Related Articles: Valuing Household Items for Probate: A Comprehensive Guide

Introduction

With great pleasure, we will explore the intriguing topic related to Valuing Household Items for Probate: A Comprehensive Guide. Let’s weave interesting information and offer fresh perspectives to the readers.

Table of Content

- 1 Related Articles: Valuing Household Items for Probate: A Comprehensive Guide

- 2 Introduction

- 3 Valuing Household Items for Probate: A Comprehensive Guide

- 3.1 The Importance of Accurate Valuation

- 3.2 Methods of Valuation

- 3.3 Factors Influencing Value

- 3.4 Expert Assistance: When to Seek Professional Valuation

- 3.5 Tips for Valuing Household Items for Probate

- 3.6 FAQs on Valuing Household Items for Probate

- 3.7 Conclusion

- 4 Closure

Valuing Household Items for Probate: A Comprehensive Guide

Probate, the legal process of administering the estate of a deceased person, often involves the valuation of the deceased’s assets. While real estate, financial accounts, and vehicles are typically straightforward to assess, personal property, specifically household items, can pose a unique challenge. This article aims to provide a comprehensive guide to valuing household items for probate, highlighting the importance of accurate valuation and offering practical tips for navigating this process.

The Importance of Accurate Valuation

Accurately valuing household items is crucial for several reasons:

- Fair Distribution of Assets: In the event of multiple beneficiaries, a fair and accurate valuation ensures the deceased’s assets are distributed equitably according to their wishes or the legal framework governing inheritance.

- Tax Implications: The value of household items is factored into the overall estate value, which can influence inheritance taxes and other relevant levies. An accurate valuation ensures accurate tax calculations and avoids potential complications or penalties.

- Dispute Resolution: In cases of disagreements among beneficiaries regarding the value of specific items, a professional valuation can provide an impartial and objective basis for resolution.

- Insurance Claims: If the household items were insured, their value may be relevant for insurance claims in the event of damage or loss.

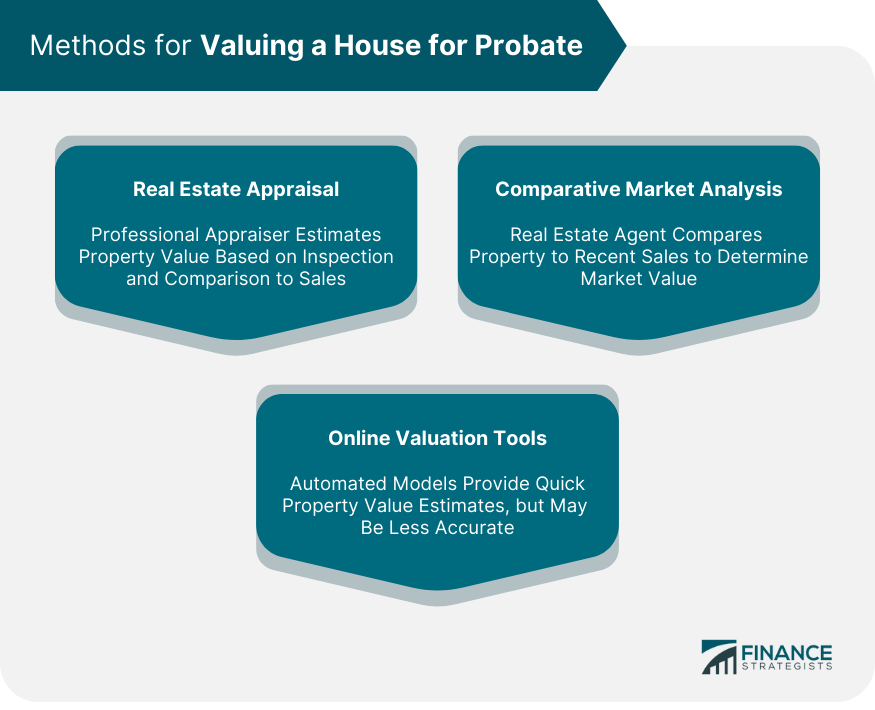

Methods of Valuation

Several methods can be employed to value household items for probate:

- Market Value: This method involves determining the price at which similar items would sell in the current market. This can be achieved through research of online marketplaces, antique shops, or consulting with appraisers.

- Replacement Value: This method focuses on the cost of replacing the item with a new one of similar quality and condition. This is often used for newer items that are readily available.

- Liquidation Value: This method considers the price the item would fetch if sold quickly, often at a discount to market value. This is relevant if the estate needs to liquidate assets quickly.

- Sentimental Value: While not directly quantifiable, sentimental value can be considered in certain cases, especially when items hold unique historical or emotional significance for the beneficiaries.

Factors Influencing Value

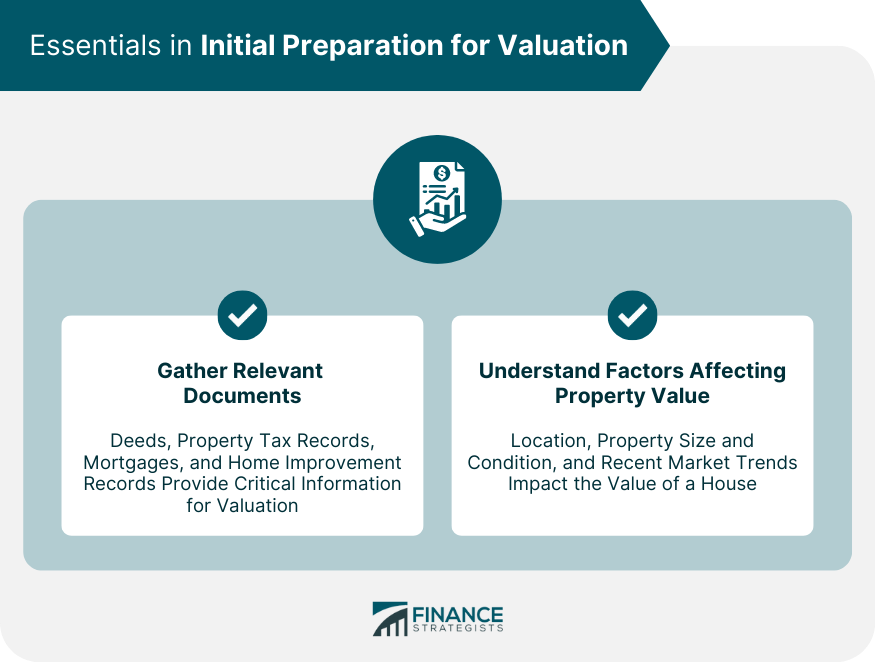

Several factors influence the value of household items, making it essential to consider them during the valuation process:

- Age and Condition: Older and well-maintained items generally command higher prices than newer, damaged, or worn items.

- Rarity and Originality: Unique or limited-edition items, antiques, or items with a specific provenance often hold higher value.

- Brand and Designer: Items from renowned brands or designers can fetch higher prices compared to generic or unknown brands.

- Material and Craftsmanship: High-quality materials, intricate craftsmanship, and detailed finishing contribute to higher value.

- Demand and Market Trends: The popularity of certain items can fluctuate based on current market trends, influencing their value.

Expert Assistance: When to Seek Professional Valuation

While some household items may be relatively easy to value, others may require expert assistance:

- Antiques and Collectibles: Valuing antiques, rare collectibles, or items with historical significance often requires the expertise of a qualified appraiser.

- Artworks and Jewelry: Artwork, sculptures, and jewelry, especially those from recognized artists or with significant historical value, need professional valuation.

- Unique or Specialized Items: Items with unusual features, specific materials, or specialized functions may require specialized knowledge for accurate valuation.

Tips for Valuing Household Items for Probate

- Gather Information: Collect as much information as possible about the items, including their age, brand, material, condition, and any relevant documentation like purchase receipts, certificates of authenticity, or appraisals.

- Research and Compare: Utilize online resources, auction databases, antique websites, and reputable appraisers to research comparable items and establish a baseline for valuation.

- Document Thoroughly: Maintain a detailed inventory of all household items, including their description, condition, and estimated value. This documentation will be essential for probate proceedings.

- Consider Multiple Perspectives: If possible, consult with multiple appraisers or experts to obtain different perspectives and ensure a comprehensive valuation.

- Seek Professional Assistance When Necessary: Don’t hesitate to engage a qualified appraiser if the items require specialized knowledge or expertise.

FAQs on Valuing Household Items for Probate

Q: What is the difference between market value and replacement value?

A: Market value reflects the price an item would fetch in the current market, considering its condition, age, and demand. Replacement value focuses on the cost of replacing the item with a new one of similar quality and condition.

Q: Is it necessary to have every household item appraised?

A: Not necessarily. Items of low value, like everyday household goods, may not require professional appraisal. However, items of significant value or with unique features should be professionally appraised.

Q: How do I determine the value of items with sentimental value?

A: Sentimental value is subjective and difficult to quantify. It’s best to consider the item’s market value and factor in its emotional significance to the beneficiaries during the distribution process.

Q: Can I use online valuation tools for probate?

A: Online valuation tools can provide a starting point, but they should not be relied upon as definitive valuations. It’s advisable to consult with a professional appraiser for a more accurate assessment.

Q: What happens if I undervalue household items in probate?

A: Undervaluing items could result in unfair distribution of assets, potential tax issues, or complications with insurance claims. It’s important to ensure accurate valuations for all items.

Q: Can I dispute a professional appraisal?

A: You can challenge an appraisal if you believe it’s inaccurate or unfair. It’s advisable to seek a second opinion from a different appraiser or consult with an estate attorney for guidance.

Conclusion

Valuing household items for probate can be a complex process, but it is crucial for ensuring a fair and transparent estate administration. By understanding the different valuation methods, factors influencing value, and seeking professional assistance when necessary, beneficiaries can navigate this process effectively and ensure the deceased’s assets are distributed equitably. Accurate valuation serves as the foundation for a smooth probate process, protecting the interests of all parties involved and honoring the deceased’s wishes.

Closure

Thus, we hope this article has provided valuable insights into Valuing Household Items for Probate: A Comprehensive Guide. We hope you find this article informative and beneficial. See you in our next article!